How has the COVID-19 pandemic affected the crypto space? Experts answer

Experts in blockchain technology and crypto take on the question: What impact has the COVID-19 outbreak had on the industry?

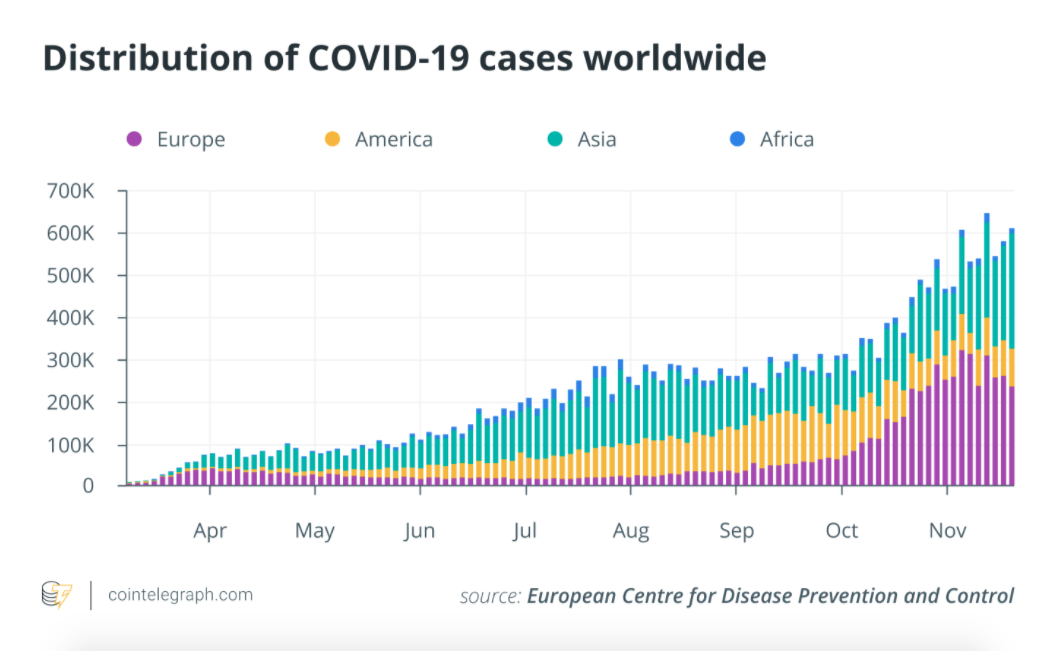

Image courtesy of CoinTelegraph

NOV 22, 2020

NOV 22, 2020

Who could have imagined a year ago how different our lives would be in just 12 months? Without any doubt, last November will remain a significant point in humanity’s history — the time when it all started. Although “patient zero” has not yet been confirmed — if it ever will be at all — we now know that everything began in China back on Nov. 17, 2019, when the first patient reportedly presented symptoms of a novel coronavirus disease named COVID-19, according to the South China Morning Post with references to government data.

In January 2020, Wuhan city in central China suffered from the massively expanding COVID-19 epidemic, and “41 admitted hospital patients had been identified as having laboratory-confirmed” cases, according to a publication in The Lancet. Just two months later, in March, the World Health Organization declared COVID-19 a global pandemic. One by one, governments worldwide closed their national borders, suspended public events, and banned people’s gatherings. The conversation unearthed two terms, rarely used before, which have now been declared 2020 words of the year by British Collins Dictionary: “lockdown” and “social distancing.”

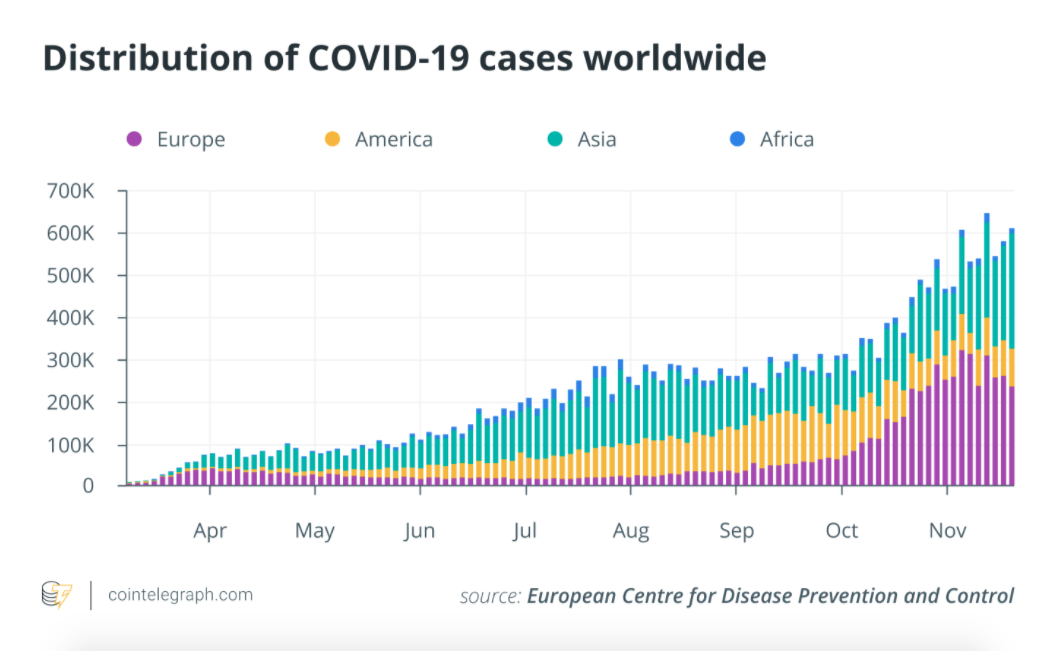

It’s hard to imagine which spheres of our lives have not been affected by these dramatic and tragic events, with the number of confirmed global cases exceeding 55 million.

(Click image for larger view)

Despite everything, the ongoing COVID-19 crisis has also had a positive impact on the world. European conservatism, which has long relied on the traditional financial system, was questioned as the pandemic forced Europeans to shift toward cashless payments and cryptocurrencies. Some say it even fastened the mainstream adoption of crypto and DLT-based business solutions globally by changing people’s understanding of money.

Related: What the COVID-19 pandemic means for blockchain and crypto

Markethive Advertisement

Specifically, the COVID-19 outbreak has propelled Bitcoin’s (BTC) safe haven narrative as central banks print an estimated $15 trillion in stimulus in an attempt to ease the pandemic’s effects on global economies. Amid rising inflation rates, people are turning to Bitcoin as the next inflation hedge.

Related: Not like before: Digital currencies debut amid COVID-19

Meanwhile, in the name of public health, governments are initiating COVID-19 tracking programs, raising serious concerns about privacy violations and the tightening grip of centralization in the process. Not stopping there, governments have also taken another step in eroding civil autonomy via the development of central bank digital currencies, initiatives for which have been boosted globally due to the COVID-19 crisis. While experts see the solution to safeguarding privacy in decentralized technologies, the question about over-promised decentralization remains open.

Nonetheless, the coronavirus outbreak significantly changed everyone’s lives, creating the new normal we now live by. Yet, despite all the challenges we are facing economically, politically and socially since the start of the year, there is no doubt that the pandemic is propelling digital innovation and accelerating humanity 20 years forward in technological development.

It is too early to tell when it all ends, as COVID-19 is still gaining speed. Now, a year since Wuhan’s first case, Cointelegraph reached out to experts in blockchain technology and the crypto space for their opinions on how the coronavirus pandemic has impacted the industry.

What impact has the outbreak of the COVID-19 pandemic had on the crypto space?

Asheesh Birla, general manager of RippleNet:

“COVID-19 exacerbated the inequities for many people who are unbanked or underbanked and highlighted the gaps that we have in our financial infrastructure where those who have the least, pay the most — on average the cost to send $200 is $14. Despite the pandemic, people still need to send money to family and friends abroad. As a result, remittances have continued to surge in some of the largest corridors. The U.S. to Mexico corridor, for example, saw a considerable increase in remittances from the start of the pandemic, with Mexico receiving $4.02 billion from abroad in March 2020, a 36% increase from March 2019. Ripple can help lower the cost of remittance payments by using crypto and blockchain to make cross-border payments faster, cheaper, and more reliable. Bitso, one of Mexico’s leading exchanges, is transacting close to 10% of total remittance flows from the U.S. to Mexico through Ripple’s technology that uses XRP as a bridge currency. In tandem, there’s more interest in the space than ever before with major companies like PayPal and Square placing their bets on crypto, pushing it to the mainstream. Validation from these companies has contributed to more interest in the utility of cryptocurrencies, and their ability to better serve their businesses and customers."

Da Hongfei, founder of Neo, founder and CEO of OnChain:

“From my perspective, COVID-19 did not negatively impact the blockchain space — if anything, it drove increased demand for blockchain innovation and adoption. By revealing the weaknesses of our current paradigm, COVID-19 also highlighted the urgent need for blockchain technology. For example, COVID-19 demonstrated the failings of today’s centralized supply chain system, revealing its fragility and lack of agility. By leveraging blockchain, we can build a decentralized supply chain which can quickly ascertain and then distribute products based on a specific area’s needs. Similarly, blockchain technology could also be deployed to more efficiently track and trace infection cases while also protecting patients’ privacy. In fact, we’re already seeing this shift to blockchain in a time of uncertainty — increasingly more institutions and people are embracing Bitcoin as it is viewed as a stable, mainstream asset in these trying times. If anything, I believe that COVID-19 firmly proved the need for not only blockchain, but also a truly digital and smart economy. Moving forward, we must break from our current paradigm to embrace a truly digitized and globalized world which has the flexibility, agility, and efficiency to flourish and thrive.”

Advertisement

Mike Belshe, CEO at BitGo:

“The economic upheaval due to our pandemic times are creating shifts in attitudes and greater interest in digital assets. COVID-19 has significantly accelerated the adoption and interest in crypto around the world. Important to note is that the determined effort of companies like ours to build a secure, compliant foundation is enabling the influx of new crypto investors, including large institutional firms such as investment banks and major custodians. Fortunately, we are able to meet the moment as a result of all the hard work we’ve put into building a new monetary system from scratch these past 10 years. Prior to COVID-19, most people weren’t paying as much attention to the economic factors that make Bitcoin relevant. Frankly, they didn’t need to. If you’re generating a return from the stock market, you stay with what you know, and you don’t have to worry about learning something new. But now that’s all changed with the pandemic — fiscal policy around the globe is causing governments to wildly print money, reducing its value and causing inflation. Investors now understand they have to get ahead of this. They are asking a lot more questions and are grasping the underpinning of Bitcoin’s thesis — that an asset’s scarcity matters. Digital assets are a hedge against inflation and a safe store of value. Investment leaders such as Paul Tudor Jones, Stanley Druckemiller and Bill Miller are demonstrating that Bitcoin is now an important part of any portfolio. This year has brought so much uncertainty but people are feeling empowered to educate themselves on what they need to do to get involved with crypto. All the building blocks are in place — compliance, custody, liquidity, portfolio management and wallet technology, as well as tax tools — giving investors the tools they need to invest in digital assets.”

Preston Byrne, Partner at Byrne & Storm, P.C.:

“The COVID-19 outbreak’s most tangible impact on crypto was validation of crypto’s core thesis that our societies are brittle and math, not men, is likely to form a sounder basis for future social organization. The reliance of practically every major economy on fiscal and monetary stimulus to stay afloat reinforced and widened public perception of the weakness of fiat money and institutions. ‘Crypto,’ so-called, is a diverse array of beliefs and areas of interest ranging from hard money, to censorship-resistance, to secure communications. These technologies are uniquely responsive to social and enterprise adaptation to stressors that have dominated headlines in the last year, whether we’re talking about ‘Money printers go brr,’ the ongoing exodus from big tech, or widespread social unrest in the cities.”

Tim Draper, venture capitalist and noted Bitcoin investor:

“A lot of people, stuck in their homes finally made the time to set up a Bitcoin wallet, but the real impact of Covid was that the lockdown was devastating for many families, and when the government printed $13 trillion to try to put a bandaid on it, it made it clear that you would rather be holding Bitcoin than these diluted and dilutable dollars. I expect ‘fiduciary duty’ to now include owning some Bitcoin as a hedge against government currency flooding and manipulation.”

These quotes have been edited and condensed.

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Original article posted on the CoinTelegraph.com site, by Max Yakubowski.

Article re-posted on Markethive by Jeffrey Sloe