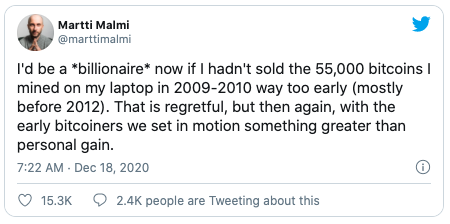

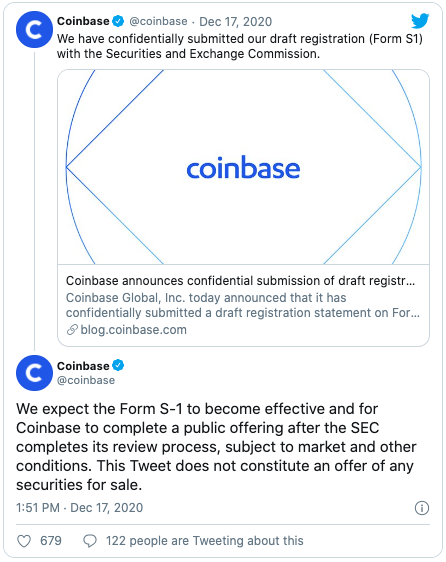

COVID Hospitalizations Fall Rapidly In US

By RTTNews Staff Writer | Published: 2/2/2021 6:08 AM ET

For comments and feedback contact: editorial@rttnews.com

The United States is witnessing significant improvement in all three metrics that measure the coronavirus pandemic's severity, with COVID-19 hospitalizations decreasing rapidly after falling below the 100,000 mark at the weekend.

Only 93,536 people are currently admitted in U.S. hospitals with coronavirus infection, which is the fewest since November 29, according to the latest data by COVID Tracking Project. Out of this, 18,572 patients are admitted in Intensive Care Units. The numbers reached a peak of 132,474 on January 6.

Compared to last week, the number of people currently hospitalized with COVID-19 is down by 10 percent or more in 38 states.

The test positivity rate continues to fall regularly. Out of nearly 1.60 million people who were tested for coronavirus on Monday, 9.78 percent were diagnosed with the disease.

With 130,759 additional cases reporting in the last 24 hours, the total U.S. cases rose to 26,317,623, according to the latest data by Johns Hopkins University. 1881 new deaths were reported across the country in the same period, taking the national total to 443,355.

January was the deadliest month in the United States so far with the pandemic, claiming the lives of 95,211 Americans, nearly 20000 more than in December.

On average, more people were hospitalized in the country than in any other month due to COVID-19.

A new projection from the University of Washington says nearly 200,000 more people are likely to die between now and May 1.

Nearly half a billion vaccine doses have been distributed across the country until Monday and at least 32,222,402 shots were administered, according to the US Centers for Disease Control and Prevention.

Anti-Covid vaccine distribution will "get better very quickly" as the Biden administration rolls out a series of measures aimed at ramping up inoculation, according to Dr. Anthony Fauci.

CDC's epidemiological expert Dr. Casey Barton Behravesh told reporters Monday that the risk of animals, including pets, spreading Covid-19 to human beings is considered to be low.

Meanwhile, Tokyo Olympic Games chief vowed that the global sports event will be held this year "no matter how the Covid situation will be."

"We will make sure the Games will be held no matter how the Covid situation will be. We go beyond the discussion of whether we hold (the Games) or not hold. We are to come up with 'new' Olympics," Games organizing committee president Yoshiro Mori said at a news conference Tuesday.

Article written by an RTT News Staff Writer, and posted on the RTT News.com website.

Article reposted on Markethive by Jeffrey Sloe