‘Stealth phase’ over? Why Wall Street FOMO will make $20K Bitcoin look cheap

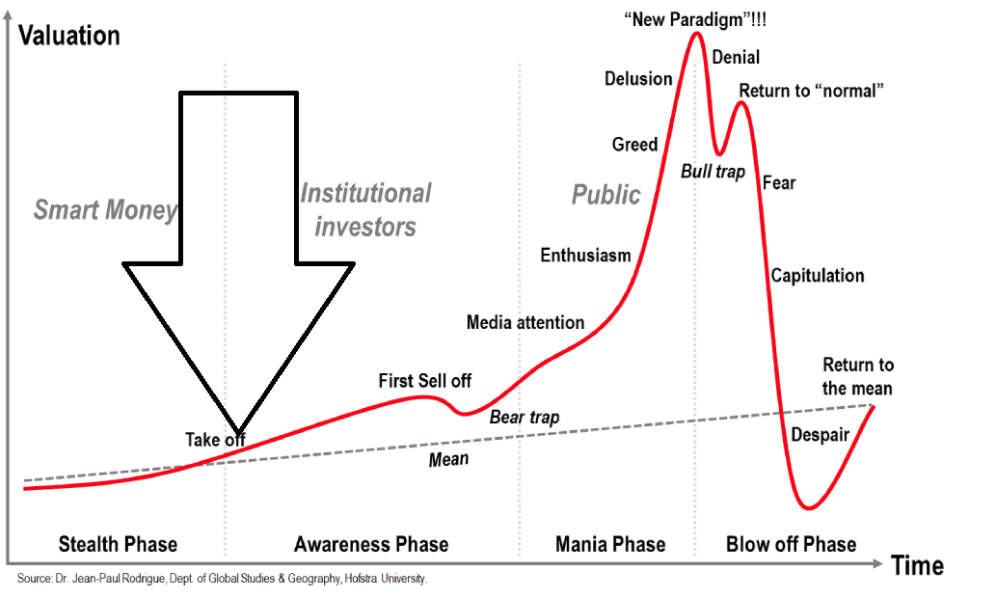

It’s becoming increasingly clear that smart money is starting to take Bitcoin seriously.

Image courtesy of CoinTelegraph

NOV 14, 2020

NOV 14, 2020

The year 2020 sucked for pretty much everyone. Unless you’re holding Bitcoin (BTC) that is.

The price of Bitcoin is up 125% year-to-date, making it once again the best-performing asset just as it has been for the past decade.

Strangely enough, the public seems completely oblivious to this fact. But not everyone is ignoring Bitcoin’s latest rally above $16,000. Currently, the price is just 20% shy of its all-time high.

Wall Street is not here yet

Considering the impressive year Bitcoin is having, it’s not surprising that Wall Street is now starting to realize that the world’s first decentralized cryptocurrency isn’t going anywhere.

Remember 2017? That historic Bitcoin price rally was largely driven by retail traders — the average Joe — who were anticipating a Wall Street stampede alongside the frenzy of new tokens minted via initial coin offerings.

At the same time, the CME introduced their cash-settled Bitcoin futures right at the peak in December 2017 and… pop!

BTC price dropped sharply in the following months and the hype fizzled into a multi-year bear market. Obituaries from the news media made the average Joe eat the loss, and many wrote Bitcoin off as just another bubble that burst.

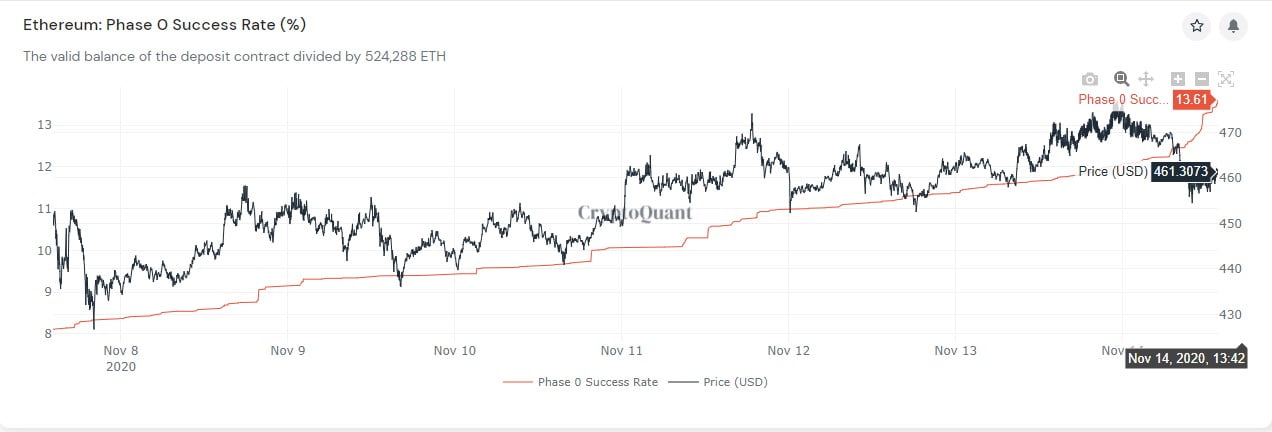

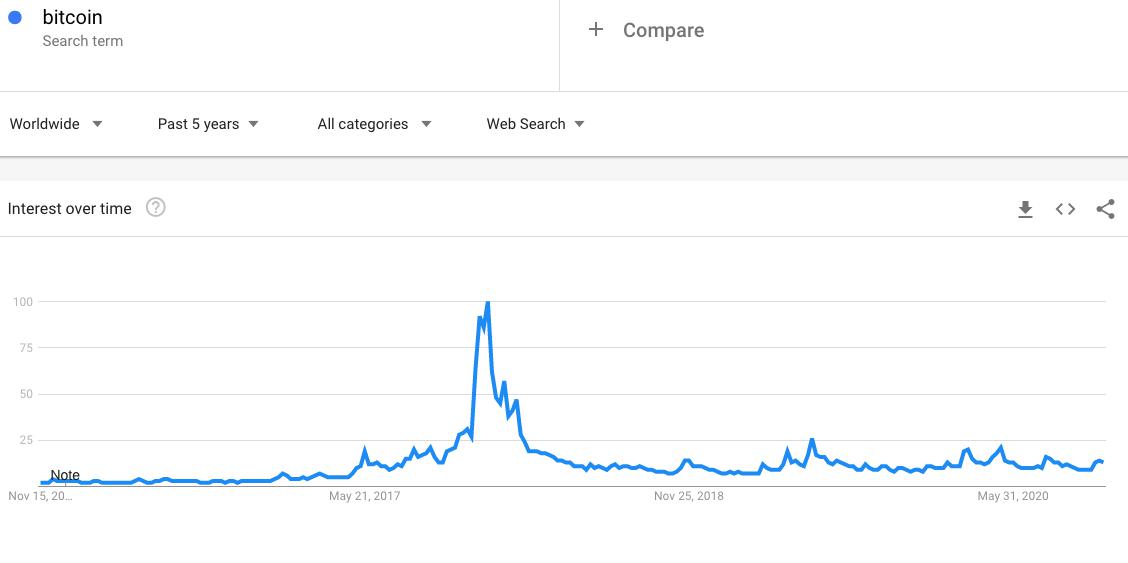

Google searches for “Bitcoin” pretty much tell the whole story.

Google Trends searches for “Bitcoin” (2015-2020). Source: Google (Click image for larger view)

But in 2020, the public searches for Bitcoin no longer reflect BTC as its price has “decoupled.”

What’s more interesting is that even Wall Street still remains largely on the sidelines suggesting that BTC may be very undervalued at $16,000 and with a market cap of $297 billion. However, the latest data suggests that this is already beginning to change.

“Wall Street is not here yet,” Gemini exchange co-founder Cameron Winklevoss explained last month. Winklevoss added:

“Institutions aren’t in Bitcoin right now. It’s been a retail phenomenon for the last decade. So Wall Street talks about it, they’re aware of Bitcoin, but they’re not really in it from our perspective, but it’s starting to happen.”

Wealthy zip-codes in New York and Silicon Valley drive BTC price

As Cointelegraph reported earlier this month, it is mainly wealthy areas in New York and Silicon Valley — home to many high-net-worth individuals — that are most interested in Bitcoin right now.

But while the public is largely unaware, several wealthy investors are heralding BTC as a new asset class. Paul Tudor Jones, Michael Saylor and Stanley Druckenmiller have made waves in 2020, revealing their positions in Bitcoin.

Do they realize something that the public did not in 2017? Was the average Joe simply too early then?

Jones said investing in BTC is like investing early in Apple stock. Saylor stated that his company, MicroStrategy, which bought up a total of $425 million in Bitcoin, will hold it for 100 years calling it “the world's best collateral.”

Meanwhile, Druckenmiller, the latest big-name Bitcoin convert, now argues that “If the gold bet works, the Bitcoin bet will probably work better.”

Together, these smart money investors are beginning to realize one thing. As Tyler Winklevoss put it:

“Bitcoin is better at being gold than gold.”

Gold is up just 23% in 2020 during a year of global economic upheaval, which is when this safe-haven metal was supposed to shine (pun intended).

But Bitcoin, or “digital gold,” has been stealing the show by gaining 125% year-to-date and up by almost 300% from its coronavirus-crash lows in March. What’s more, BTC’s market cap is just 2.36% of gold’s, which some long-term investors see as the best asymmetric risk-reward ratio bet in history.

Individuals who bought Bitcoin 10 or even five years ago would most likely agree.

The end of Bitcoin’s “stealth phase”

With its fixed supply, Bitcoin is becoming particularly attractive as a hedge against inflation, which is all but guaranteed by the United States Federal Reserve.

But unlike gold, Bitcoin is absolutely scarce. Its supply is mathematically fixed and cannot be changed by any authority.

What’s more, the rate at which new BTC is mined is reduced by 50% every four years, which analysts argue is one of the biggest catalysts for new bull market cycles. This event is called the halving, with the last one occurring in May 2020.

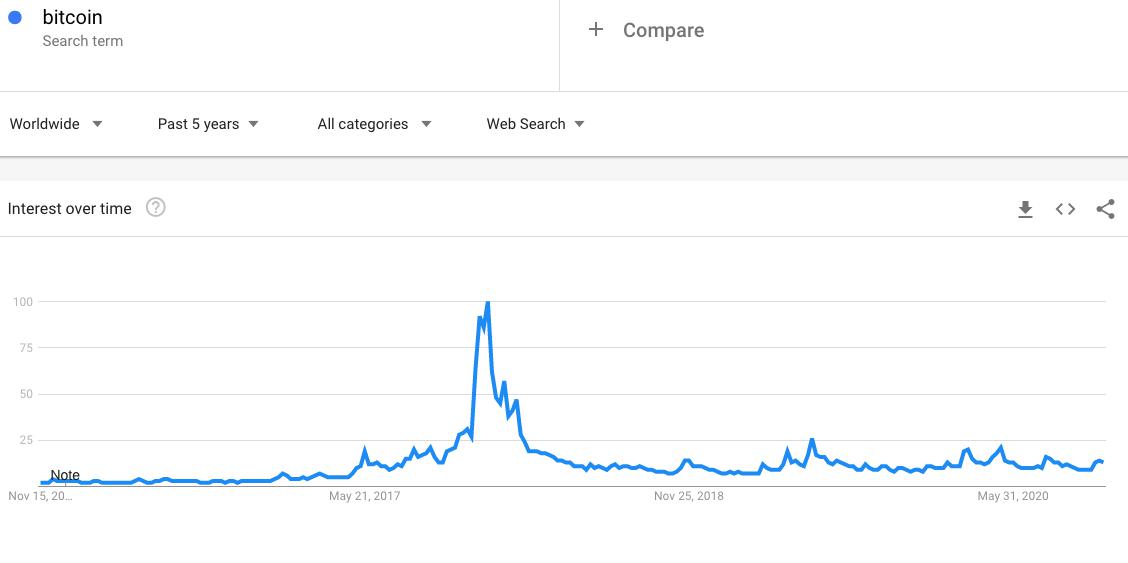

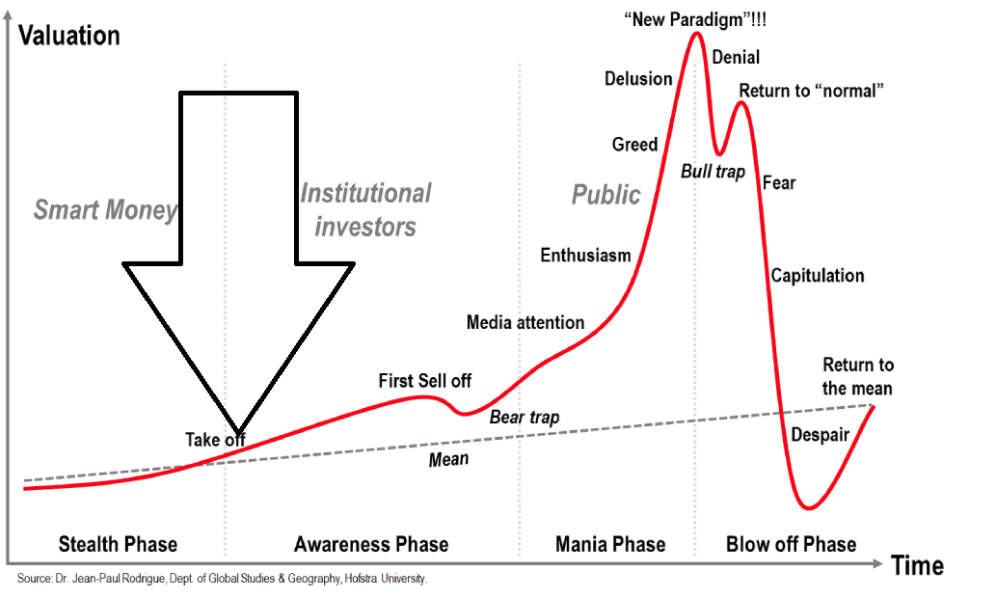

Market sentiment cycle. Source: Michaël van de Poppe (Click image for larger view)

Cryptocurrency trader Michaël van de Poppe believes that the Bitcoin market is now exiting the Stealth Phase and entering the Awareness Phase. No longer is BTC just digital money for buying drugs on the dark web.

According to van de Poppe:

“With Stan Druckenmiller, Michael Saylor, and more listed companies jumping into the Bitcoin markets, it’s quite clear that we’re at the early stage of a new bull cycle.”

Bitcoin is a small club, and you can be in it

In addition to the halving, the aforementioned investors have also noticed that BTC’s fundamentals, network activity, and on-ramp infrastructure (e.g. Cash App, PayPal) have all significantly improved since 2017. So it’s not surprising that this emerging asset class is starting to look like a no-brainer bet to smart money.

Other investors will also eventually realize that a small allocation of capital into Bitcoin significantly boosts portfolio returns. Last month, the co-founder of 10T Holdings, Dan Tapiero, noted:

“Only 3% BTC position in past 5yrs would have increased performance of a 60/40 portfolio from 6.8% to 10.2%.”

At this rate, investment fund clients will begin asking questions such as: Why is my nephew’s Bitcoin stash outperforming my 401K, FAANG stocks, gold, and Warren Buffett put together? How do I gain exposure to Bitcoin?

But what makes Bitcoin truly unique is that it doesn’t play by Wall Street’s rules. It’s software with its own set of rules. It is not a stock or an IPO. It’s a technology that’s open to all and voluntary to use. It has early adopters, not insiders. It has market cycles, not bailouts. It has existed for over a decade and grows stronger by the day.

Despite already existing for nearly 12 years, Bitcoin is only now starting to be noticed and taken seriously by serious investors. At the same time, it maintains the lowest barrier to entry for everyone else compared to traditional finance.

This is precisely why Bitcoin still presents a unique opportunity for the average Joe: to acquire BTC now at lower prices than what Wall Street will pay for it later.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Markethive Advertisement

Original article posted on the CoinTelegraph.com site, by Allen Scott.

Article re-posted on Markethive by Jeffrey Sloe