Zeus Capital Offers $100k For Info on ChainLink’s ‘Illicit Practices’

John P. Njui • BITCOIN (BTC) NEWS • NOVEMBER 12, 2020

In brief:

- Zeus Capital has launched a rewards program seeking information on ChainLink’s ‘manipulative and illicit practices’

- The reward has been capped at $100k for sufficient information

- Zeus Capital is preparing a class action suit against ChainLink

- They claim the project has been spreading misleading information and manipulating the price of LINK

The team at Zeus Capital has launched a rewards program for the ‘provision of information of ChainLink’s manipulative and illicit practices’. The reward has been capped at $100,000 for sufficient information regarding what Zeus Capital claims as ‘misleading information on ChainLink partnerships’ and ‘outright market manipulation’ of the LINK token.

Below is the tweet by Zeus Capital announcing the $100,000 rewards program.

Zeus Capital is Preparing a Class Action Suit against the ChainLink Project

Furthermore, the team at Zeus Capital has announced that they are preparing a class-action lawsuit against the ChainLink project and its team. They claim to be working with a group of institutional investors and victims of the Chainlink fraud. Zeus Captial further explains why they have continually targeted the ChainLink project.

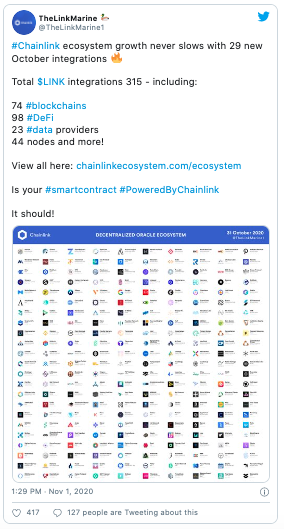

Up to now, the project has been alleged in spreading misleading information about the nature and authenticity of Chainlink’s partnerships, the development and funding of a network of sponsored social media accounts that participate in outright market manipulations, and the sale of the LINK token that exhibits security-type features.

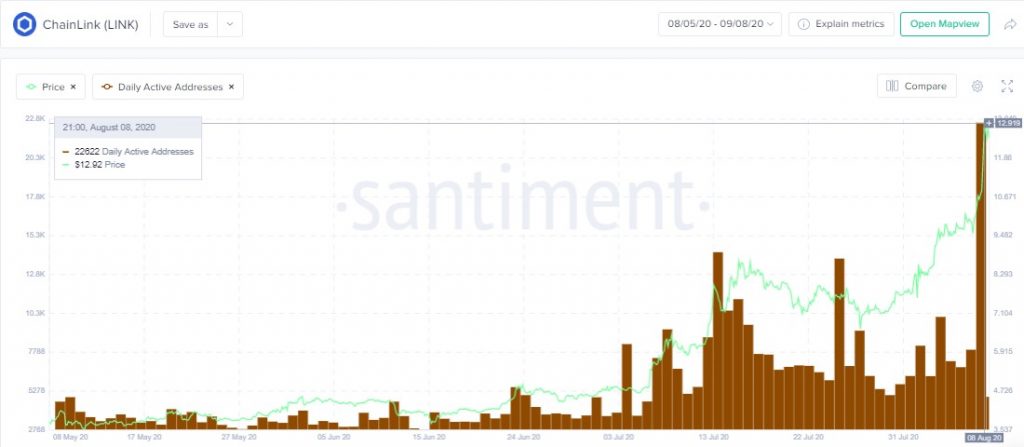

ChainLink is Selling 1 Million Link Per Week – Zeus Capital

To back up their claims that the team at ChainLink is manipulating the price of LINK, the team at Zeus Capital claims that they have been selling 1 Million LINK tokens per week. According to Zeus Capital, the team behind ChainLink used to sell LINK tokens of this value in a month, and an acceleration of sales raises more questions and answers.

Chainlink used to sell 1M per month, now it is 1M per week. Stop pouring your money into the abyss. What happened? Or maybe… what is about to happen?

To back up their claims, Zeus Capital has highlighted several LINK transactions as seen in the following screenshot of a recent tweet. Within the tweet is a warning to investors asking them to ‘stop pouring their money into the abyss’.

Original article posted on the EthereumWorldNews.com site, by John P. Njui.

Article re-posted on Markethive by Jeffrey Sloe