Bitcoin price tipped to consolidate before continuing bull run in 2021

The Bitcoin price could stagnate until early 2021, various on-chain indicators show, as investors could take profit.

Image courtesy of CoinTelegraph

DEC 15, 2020

DEC 15, 2020

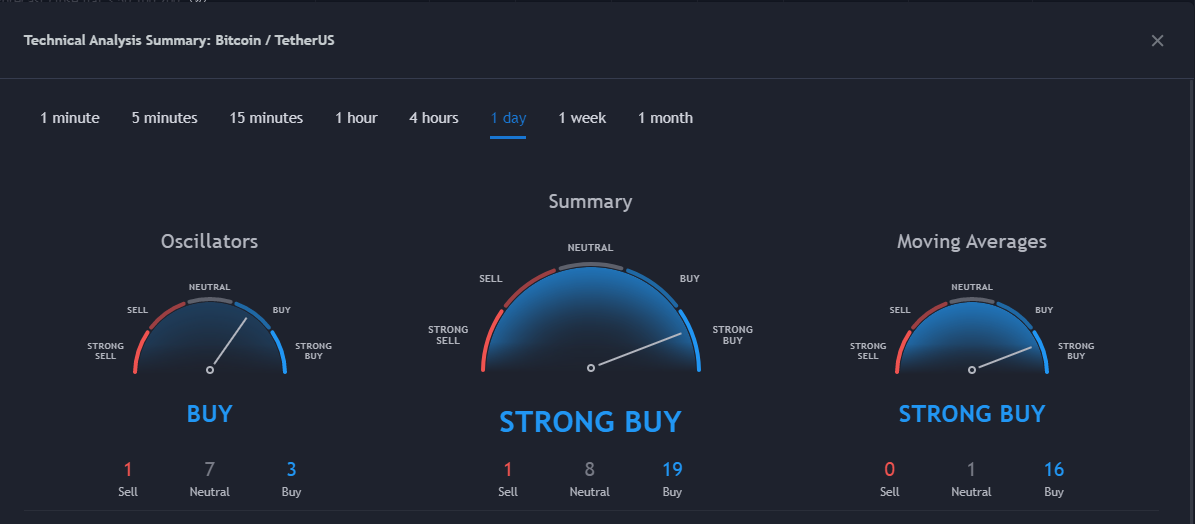

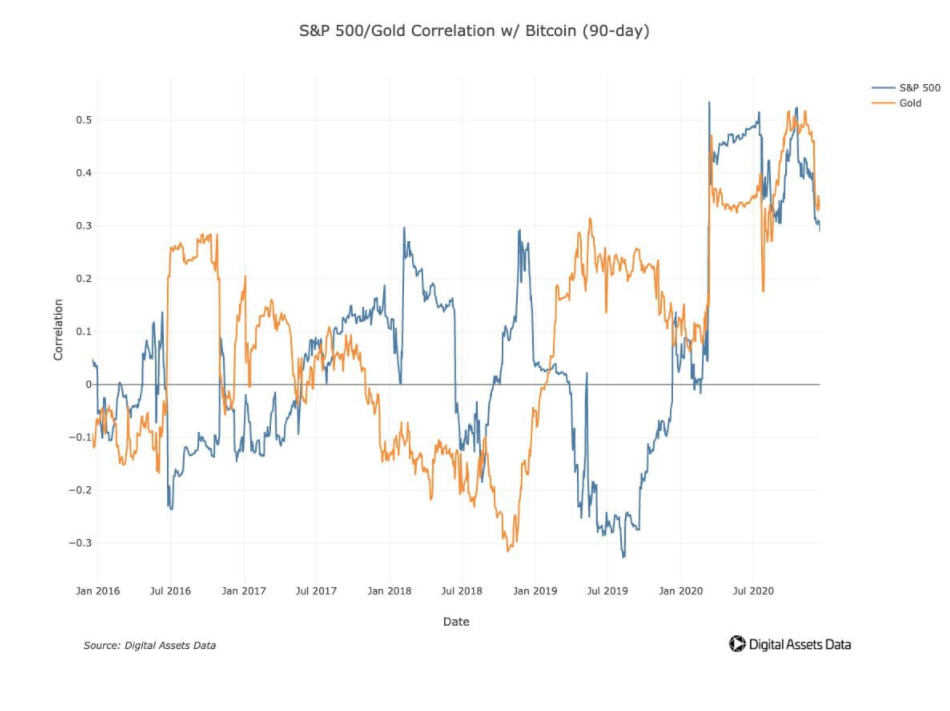

The Bitcoin price (BTC) reached the $19,400 mark in the past 24 hours, which has served as a critical resistance level since the start of December. However, on-chain indicators show that the dominant cryptocurrency could stagnate or consolidate until early 2021. Although BTC is nearing its all-time high at around $20,000, there are compelling reasons to expect more sideways action.

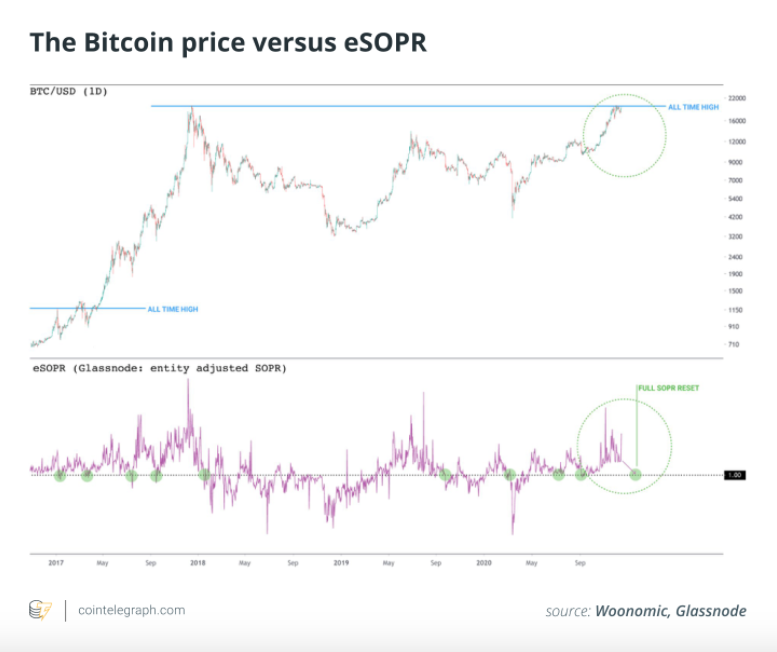

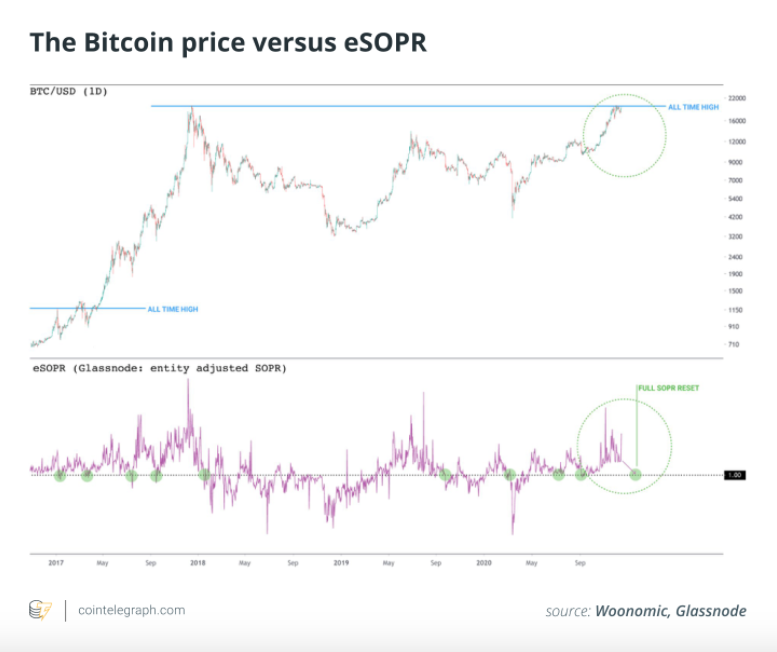

On-chain analysts primarily explore two indicators to gauge the sentiment of an ongoing rally: the Spent Output Profit Ratio, or SOPR, and Long-Term Holder MVRV. The SOPR indicator shows whether short-term holders are selling at a profit or a loss. If SOPR increases, it means investors are selling at a profit, which typically means there is room for a minor correction. But if the SOPR decreases, it means retail investors are likely getting shaken out, and a trend reversal to the upside is likely.

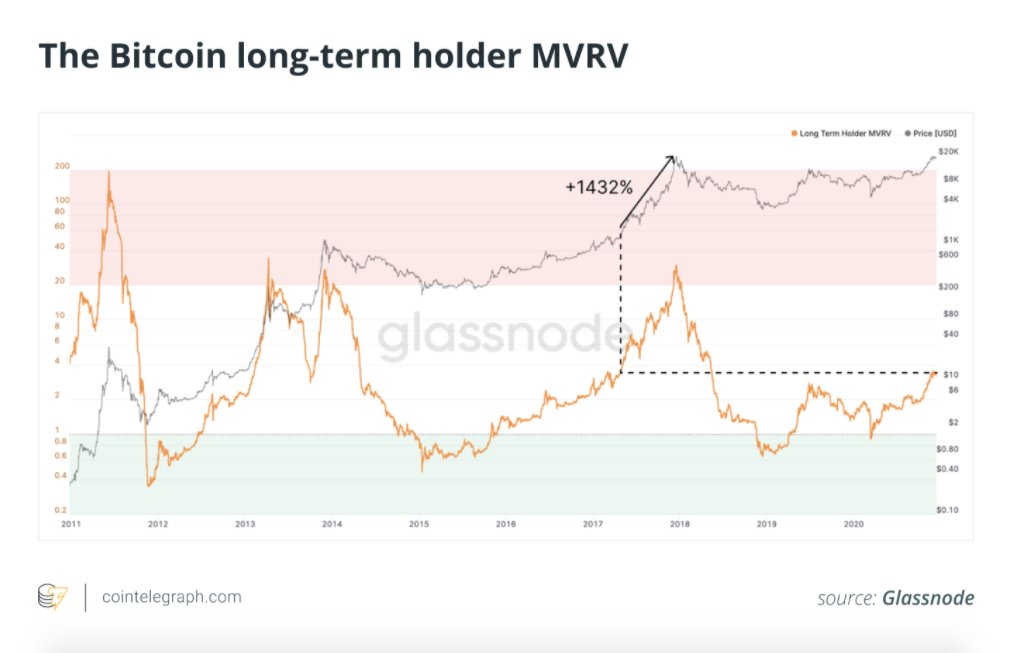

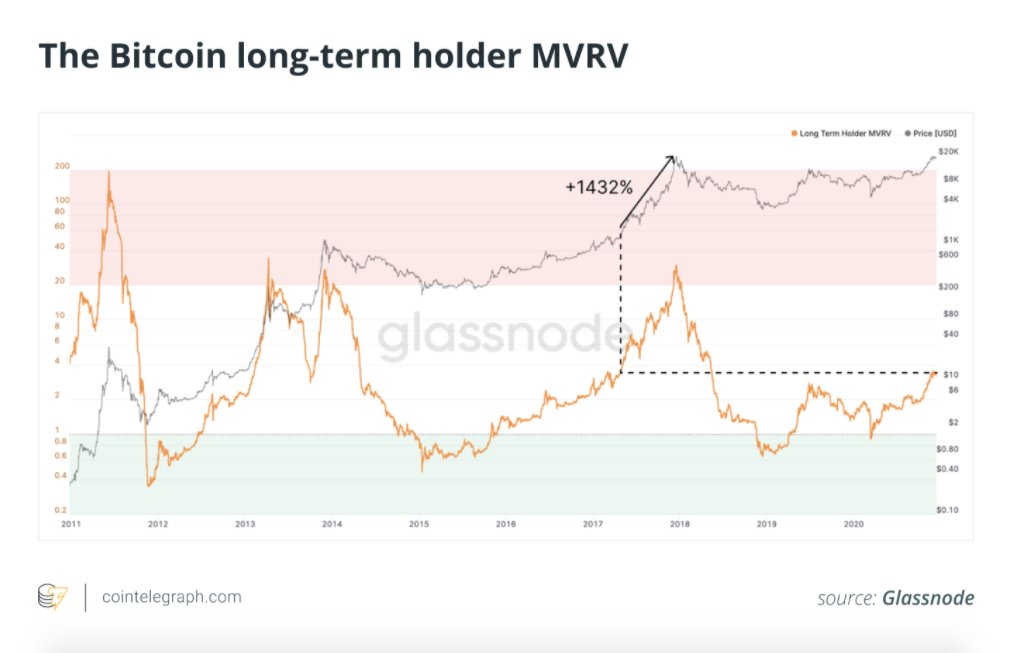

The Long-Term Holder MVRV is an indicator that looks at whether Bitcoin is overvalued or undervalued. The MVRV divides the price at which investors are buying Bitcoin by the current market cap. It allows the indicator to gauge whether investors accumulate BTC at an abnormally high price, making the rally overheated. A rally becomes unsustainable if MVRV goes above 20.

SOPR and MVRV in action

Bitcoin is currently in an ideal position, where the SOPR indicator is signaling the likelihood of a further profit-taking pullback, while the MVRV is indicating a long-term rally. This trend is positive for BTC, since it shows that the overall uptrend would likely be intact even if a short-term correction or consolidation phases occur.

Willy Woo, an on-chain analyst and the creator of Woobull.com, said the SOPR has room to reset. Based on historical cycles, Woo noted that it could take until January to happen. Hence, at least in the near term, Bitcoin’s probability of consolidating or stagnating for a longer period remains high. While this does not mean that BTC would see a significant correction, it could result in lower volatility and a more cautious near-term price trend. Woo explained:

“Once SOPR starts declining, profit taking begets profit taking. We wait until all investors in profit who are going to sell to complete their sell off, when this happens, coins moving no longer carry profit, SOPR goes to 1.0, and we can move forward. ETA January perhaps.”

One positive factor that could offset a potential SOPR-induced sell-off in the short to medium term is the Long-Term Holder MVRV. Glassnode analysts explained that the MVRV is far from the danger zone, which previously marked local tops. For example, when Bitcoin hit an all-time high in December 2017, the Long-Term Holder MVRV surpassed 20. In contrast, this metric is currently at around 3.

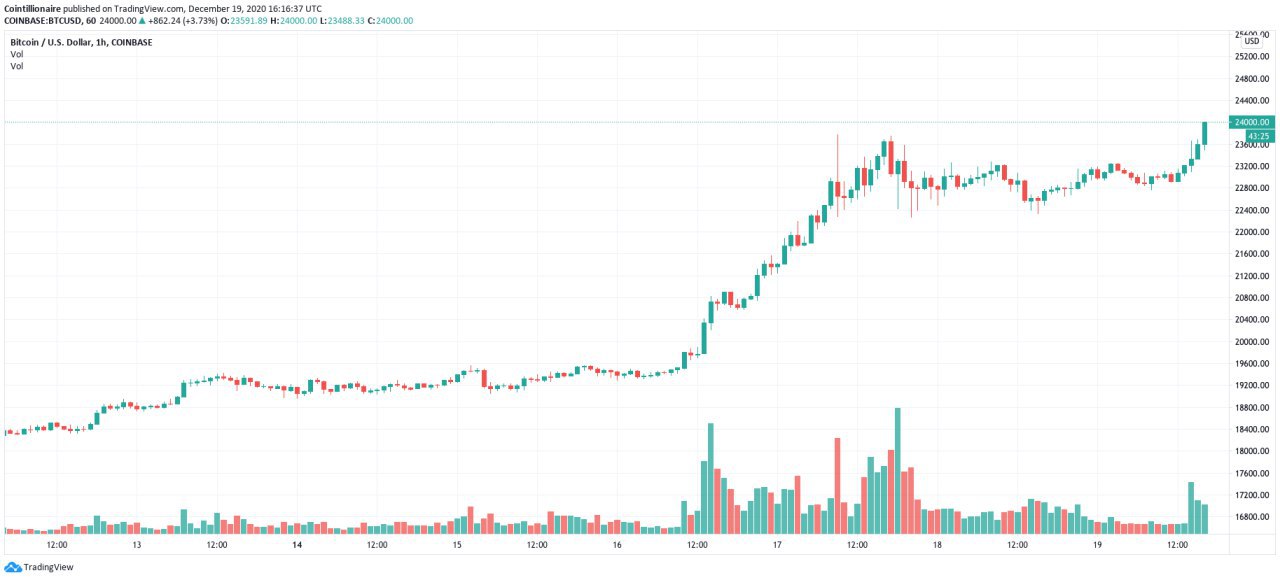

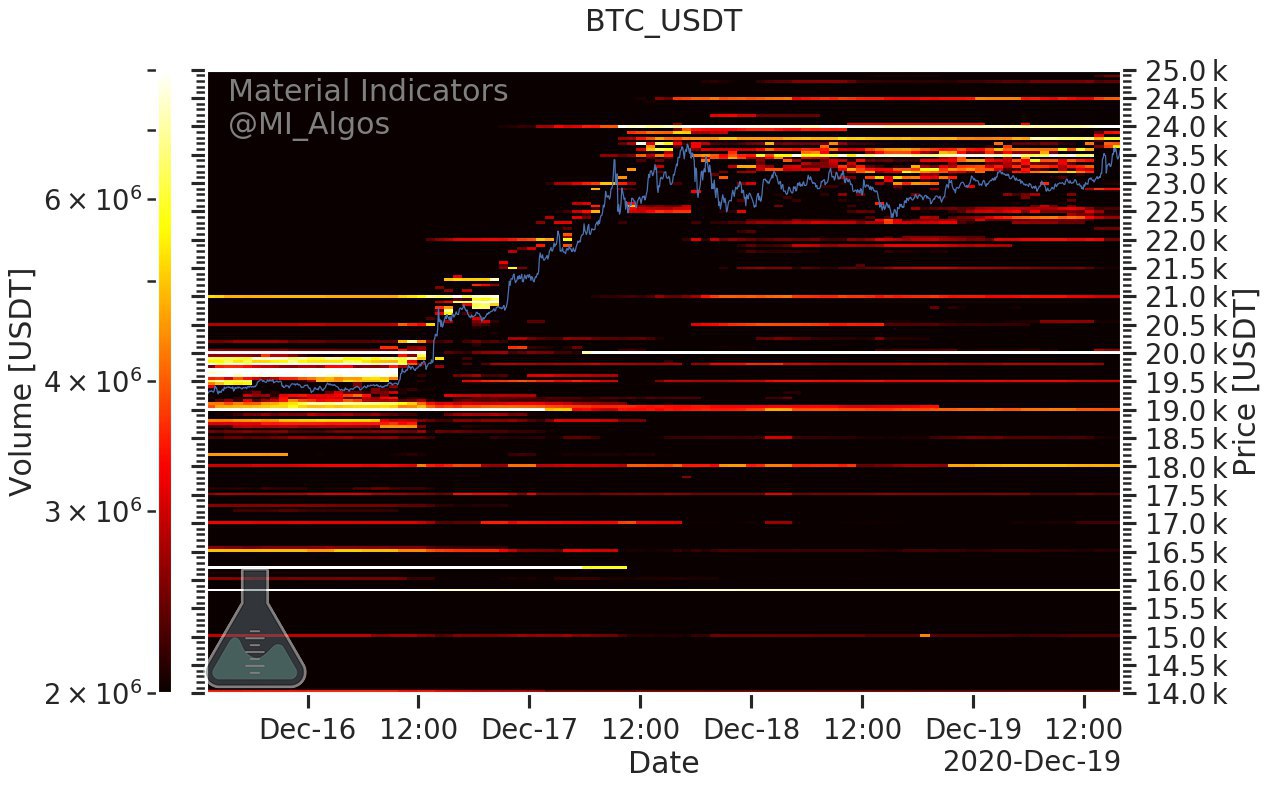

(Click image for larger view)

Both SOPR and MVRV suggest that Bitcoin is still in the early phase of its bull cycle. SOPR is substantially lower than where it was during the 2017 peak, similar to MVRV. It goes in line with the narrative of a post-halving cycle, where Bitcoin tends to peak 12 to 15 months after a block reward halving occurs. If a similar cycle as the last halving in mid-2016 repeats, BTC could peak in mid-2021.

Glassnode analysts explained that the MVRV ratio is currently extremely bullish, adding: “When LTH-MVRV reaches the red zone (above 20), this generally indicates a global top. But as we can see in the chart below, Bitcoin’s LTH-MVRV is still very far from the red zone.”

(Click image for larger view)

If $20,000 breaks, a bigger rally could start

However, Bitcoin breaking past $20,000 is a possibility in the near term. There are mixed opinions about what comes next after BTC cleanly breaches its record high. Some believe there could be a blow-off top in the $20,000 to $21,000 range as euphoria peaks. Others say that retail interest in Bitcoin could begin.

There are two main reasons why the mainstream interest in Bitcoin would rise after BTC reaches a new all-time high. First, many retail investors lost large sums of capital in 2017 by buying near $20,000. As such, the all-time high remains a roadblock for many investors. Secondly, there is no historical ceiling for BTC above $20,000, so the price discovery period will likely begin.

A pseudonymous technical analyst known as “Crypto Monk” said a break of $20,000 presents the “max pain scenario”: “All those people who could have jumped in below $10k but decided to pass by targeting crazy low prices are now hoping for a massive pullback to get a second chance.”

Eric Thies, a cryptocurrency trader, told Cointelegraph that he expects Bitcoin to break $20,000. Thies said Bitcoin would likely see a newfound rally in January 2021 that would continue the ongoing uptrend after some consolidation:

“I’d expect with recent news of bank interest and continued retail growth, Bitcoin will soon be in the $20,000 zones and beyond. It’s no doubt we see continuation of this uptrend and birth of a new bull run. The best option for entries may come now in the $19,000 range or if we happen to break down from here, the entries will be quick to fill in $15,000 during these consolidation efforts. In January 2021 we will see new highs for Bitcoin.”

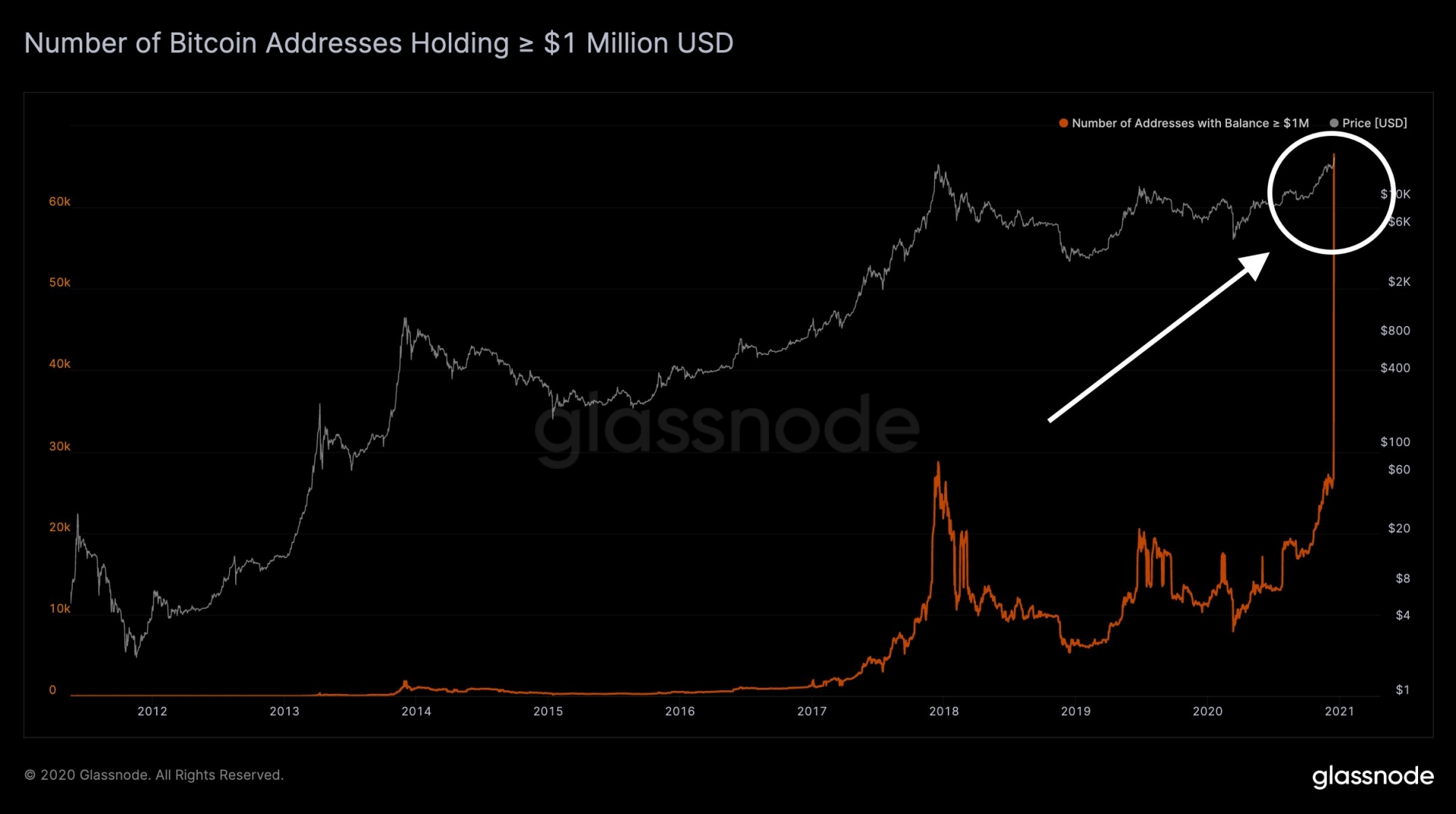

Alongside the historical significance of Bitcoin surpassing $20,000, on-chain data suggests that the number of BTC holders is generally increasing. On Dec. 10, the number of Bitcoin addresses with a balance reached 33.22 million, according to researchers at IntoTheBlock. This is a record high, and it suggests that the retail interest in BTC is increasing.

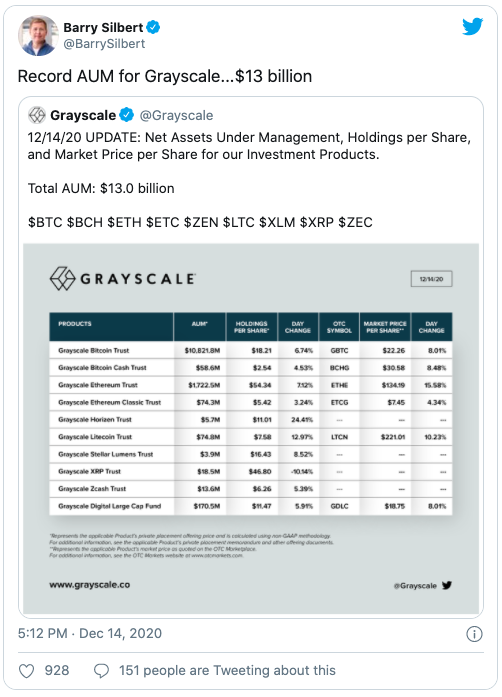

Atop the strong on-chain fundamental factors buoying the ongoing rally, the institutional demand for Bitcoin continues to increase. On Dec. 15, Barry Silbert, the CEO of Grayscale, said the firm achieved $13 billion in assets under management. This is indicative of increasing institutional appetite for an exchange-traded fund alternative among accredited investors in the United States.

The sustained institutional demand for Bitcoin has been crucial for the recent uptrend because it has made traders cautious in net-shorting BTC. The Bitcoin price was at risk of major corrections several times in the past week, most notably, the threat of a larger pullback to the $16,000 macro support area when the price fell under $18,000.

Yet, traders seem reluctant to short Bitcoin due to the unpredictability of institutions accumulating BTC. A pseudonymous trader known as “Bitcoin Jack” said that he doesn’t want to bet against the billionaires, adding: “A cash position is the moderate approach between downside risk mitigation and getting blown up to the up-/downside. Reality is that I don’t know what will happen from here. Big cash flows are entering Bitcoin.”

Markethive Advertisement

Original article posted on the CoinTelegraph.com site, by Joseph Young.

Article re-posted on Markethive by Jeffrey Sloe