Crypto Communities – How Valuable Are They?

There seems to be some disillusionment about Crypto and Community or to put it more succinctly, “Crypto Community” in the wake of historical events of the past year. 2018 was notorious for ICO failures, ponzi scams, false hype, and FUD. Some are saying Crypto has an ethics problem. More to the point, it could be said it’s some people within the crypto space that have an ethics problem. Just as we’ve seen in the “real world” of fiat currency, banks, governments, and entrepreneurial shysters. For decades this game of greed has been played out leaving scores of victims.

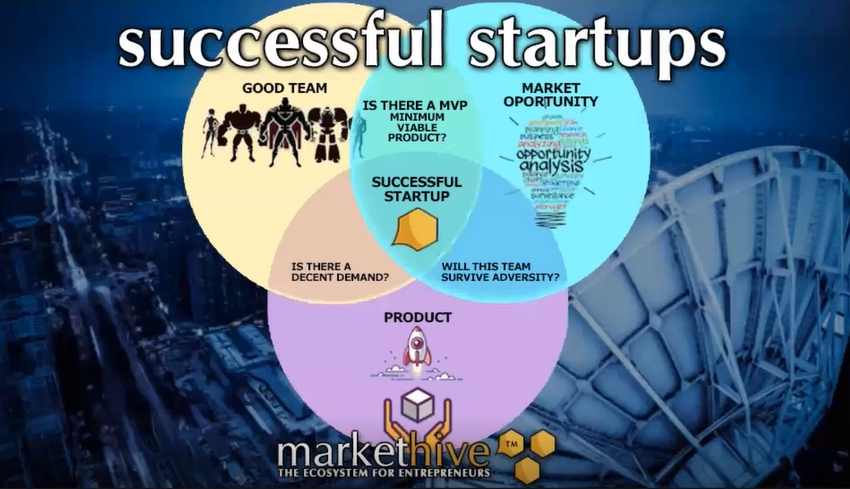

We have seen the profiteering with this nascent industry at the misfortune of others. Also, startups have been too quick to launch an idea with no real thought or products to underpin it. The idea that the larger their community the more valuable the coin does nothing for sustainability. With that mindset and no real product, gives rise to pump and dump scenarios which result in the coin losing value, and rarely, if at all, recovers.

Airdrops have been initiated to increase awareness and customer base only to find the majority dump their coins at the first available opportunity. Some of it’s the” get rich quick” mentality and “pump & dump” culture that has been created but apart from that and of course, the technology getting into the wrong greedy hands, what else are these ICOs doing wrong to result in failure?

2018 was the Year of the Cryptocalypse

We need to turn this culture around and treat it like it was meant to be treated as stated by the founder of Bitcoin, Satoshi Nakamoto 10 years ago. All companies need a product or a purpose that is needed and sought after by the community. They cannot ride on the coattails of what their coin might be worth just due to its initial popularity.

Last year will go down in history as the crypto apocalypse, this year will be the year of the cuts. There are good things happening behind the scenes with crypto and blockchain technology. This industry has made its mark and here to stay. The companies who have survived last year and continue to grow this year will be ones of integrity and substance. All others will fall away.

The Crypto Industry Is Growing Up

Considering much of the “real world” is online these days with Entrepreneurship classed as a real occupation there are some companies that offer real products to real clients. Blockchain Technology is being implemented in many industries, not just in finance, but in health, logistics and now social & market networks and as a result, freeing the broader society from the antiquated hierarchy of today.

In the case of cryptocurrency, it has its place in the world of ecosystems. Particularly helpful to the unbanked. Trading in crypto is only a sideline gig for enthusiasts, even though it’s perceived to be in the forefront and the only thing crypto is meant for. What is evolving in the real-world is an ecosystem where crypto is fluid and can have real value providing there is a product fit and the Ideology is one of integrity.

For the viability of any crypto business ecosystem, there needs to be Community, Technology, and Liquidity. Digital money viability is established through the interaction between these three groups within the ecosystem. There is no viability if these interrelated groups do not exist.

Airdrops do have their Place in Successful Startups

Paypal executed an incentive to attract more customers back in the beginning as do many businesses with loyalty programs. Crypto-based businesses can have the same success with a utility or consumer coin that adds value to the experience of the user. If introduced correctly, with products and services underpinning the system, there is enormous growth potential where its customers use the products and are rewarded for using them. This creates loyalty and a community is built. The coins are part of the ecosystem, not the pinnacle. But who does that? Is this just a future concept? No, It’s here now with Markethive.

The Next Generation

As I said earlier, much of the real-world operates online and Entrepreneurs are now classed as having a real occupation. Markethive was born with that in mind, but since the advent of the latest technology, it has gone one step further and is now built on the blockchain with its own coin. (MHV) Markethive has just completed its first airdrop with micropayments and tips now active within the system. There are many happy campers within the community…

Markethive Associate, Ven Dance states,

“One way that companies that are sincere in their desire to provide the crypto community a legitimate opportunity to improve their lives and benefit in the crypto market place is to have real, tangible products and or services in place and ready before offering public financial participation. Companies that have “real” services and products are now utilizing the ILP (Initial Loan Procurement) Unlike the ICO, the ILP, it is a loan that has to be paid back. What a novel concept, yes it has to be paid back. There are only a few companies that are offering the crypto community this type of opportunity… products, and services that are functional now and are using an investment vehicle that requires the investment to be paid back. MarketHive…Welcome to the real world of crypto evolution and the communities that believe in it and support it.”

Louis Harvey says,

“I think that we all at some point need connection and interaction being real world or a community-based platform! Markethive is providing this typesetting in a secure community with the privacy all being built on the blockchain. How cool is that when you need support of any kind the community base platform is here.”

Richard Mathiason says,

“Markethive is more focused on fixing the problems with present-day social networks. Those problems are privacy issues, security issues, using Inbound Marketing instead outdated forced marketing and making sure that the business platform is not reliant on how well the cryptocurrency “does”. In our case, the cryptocurrency is not being hyped and will only do well if the business proposition is solid. A micro- payment system has been implemented which is also new to social networks. It has only been in place less than a week and it is having a positive effect on the company. Finally, we are not an ICO, we are crowdfunding using ILP’s (initial loan procurement). Markethive has made the community the most important item in the company. And that is why it will succeed!”

Conclusion

Markethive is a predominantly free system that allows freedom of speech, total privacy, and transparency, promoting education for the youth through to the seasoned entrepreneur providing support, network, tools and motivation to experience entrepreneurialism, sovereignty and success resulting in a complete ecosystem with universal income.

Markethive is creating a social network that is integrated with state of the art blockchain, cryptocurrency, and inbound marketing technology. Because Markethive is decentralized, autonomous and controlled by its entrepreneurs and holders of MARKETHIVE, its coin (MHV), will share and benefit from its success.

Blockchain-based Companies like Markethive, derive their profit from the projects that are underpinning it, plus the products and services they deliver, therefore they are able to give back to its users in many forms, including remuneration for using the platform. In essence, they give the power back to the people.

Is the crypto community valuable? Yes, they should be the focal point of any business. They are the lifeblood. Facebook with its current business model is valuable because of its 2 billion users, however, their misuse of data and lack of consideration for their users is questionable.

Keep an eye on Markethive (MHV) It’s a force to be reckoned with. It’s leading edge of the new blockchain, the new Market Networks and the new decentralized solution to the elite big data tyrants like Facebook and Google.

The global financial system and social media are broken and business ecosystems need a better way to do things. With Markethive it’s here.

Original article posted on zycrypto.com

Article posted on Markethive by Jeffrey Sloe

The group of companies calls itself the “Securing America’s Internet of Value Coalition” and is currently formed by Ripple Labs, the independent foundation Ripple Works, Coil – a fintech that seeks to facilitate payments in the entertainment and digital content industry, Hard Yaka – a firm with large sums of money invested in digital assets – and PolySign – a startup that seeks to provide crypto custody services.

The group of companies calls itself the “Securing America’s Internet of Value Coalition” and is currently formed by Ripple Labs, the independent foundation Ripple Works, Coil – a fintech that seeks to facilitate payments in the entertainment and digital content industry, Hard Yaka – a firm with large sums of money invested in digital assets – and PolySign – a startup that seeks to provide crypto custody services.