Feeling stuck in life from time to time – is a part of being human. Yet, if one dwells on being stuck one will remain stuck. Thus, you need to accept feeling stuck as an opportunity to regroup and revitalize. What you focus on is what you will experience.

Furthermore, the good news is there are steps you can take to end stagnation, be more productive and move towards your goals faster than before!

Whether you find yourself in an exercise slump, relationship rut, a career funk, or business funk remember that you are far more powerful and empowered than any circumstance, situation or condition you may face.

Stagnation will be short-lived when you decide to make changes for the better.

These changes will give you direction to get out of being stuck.

1. Release the past.

Listen to the stories you tell yourself. Are you ruminating about past events? Are you unable to forgive yourself for mistakes? Are you blaming yourself or others for things that did not turn out the way you intended? Ask yourself why you are stuck on those memories, and what you can learn from them, thank them for teaching you, and move forward. You can't undo the past, but you can choose to learn from the past and to create peace. Forgiving yourself or others is a way to let go and move on.

2. Change your perspective.

When you release the grip of the past, you will see your reality in new ways and feel freer to change your attitude. To gain a new perspective, meditate or spend time alone and listen to your inner voice. If you can, take a break from your daily routine to clear your mind and get distance from your current situation. Open yourself up to new people and ideas, and introduce regular physical activity into your routine. All of these changes will assist you to gain a new perspective and new possibilities.

3. Make small changes.

People often think they need to make huge changes–turn the place upside down or throw everything out and start over. On the contrary, making the right small changes make a huge difference. Change stimulates the brain that will improve creativity and clarity of mind. Start by changing your daily routine, moving things in your home, reengage with friends or make new friends. Every choice matters. You might be tempted to skip the little things because they don't seem important at the moment. However, an accumulation of small changes will assist you to accomplish your goals more effectively and efficiently, and you will become unstuck.

4. Explore your purpose.

Your life purpose is not just your job, career, business, your responsibilities, or your goals—it's what makes you feel alive. These are the things you are passionate about and will fight for. Examples of a life purpose could be:

- Helping others reach their full potential.

- Growing within yourself.

- Protecting animals from cruelty.

- Engaging in a new hobby.

- Exploring nature–include all elements (air, fire, water, soil).

You may need to change your life purpose if it no longer inspires you. Or, if you sense your chosen purpose has been fulfilled, this is a great time to choose another. Ask yourself the following questions as you consider your life purpose:

- What do I enjoy doing for fun?

- What are my favorite things to do?

- What have I thought of doing and haven't?

- When do I enjoy doing so much or become so committed to something that I lose track of time?

- Who or what inspires me the most, and why?

- What prompts me to feel good about myself?

- What am I good at?

5. Believe in me.

I trust myself that I can reach my expectations and move out of my comfort zone. Make a list of my strengths and positive traits, and remember what I am capable of. Many people sabotage their own progress—consciously or unconsciously—as a result of deep-seated fears and limiting beliefs. Ditch all fear and limiting beliefs. As the cliche goes–Fear is only False Evidence Appearing Real. In fact, you create your fear, there is nothing to fear. Of course, there are reasons to avoid things, like stepping into a rattlesnake den, free fall off a building, but you don't need to fear snakes or heights in order to be mindful to make appropriate decisions to keep yourself safe.

The first step to believing in yourself is to recognize your self-doubt. Pay attention to the ways you react to situations. Then you can work to reframe your self-doubt. Limitations like, "I can't", "I don't know", "What if…?" can be replaced with, "I can do it, I'll work on it," or "I will learn how." Another way to instill confidence in your abilities is to write down your past successes and keep the notes on hand when you need proof that you can do things that are challenging or new.

6. Practice Trust and Faith.

Trust and Faith are the most powerful and empowering mindsets possible. Maybe you have had many disappointments that prompted you to feel helpless and hopeless. Maybe you are experiencing protective pessimism. You need to listen to what you say to yourself–when you hear yourself say, limiting comments or pessimistic words change to optimistic thoughts. Find a practice, such as mindfulness, meditation, affirmation, or reading inspirational articles/books regularly. Trust and Faith are a birthright. Everyone has the right to set forth Trust and Faith. Remind yourself to stay focused on Trust and Faith moment to moment all ways.

7. Consider working with a professional–Holistic Mentor/Coach or a Mental/Emotional Healing Practitioner.

If you discover you are unable to change unhealthy thought patterns, working with a Mental/Emotional Healing Practitioner to assist to you to discover why you are stuck and to find ways to get unstuck is more cost effective and practical than struggling. Being stuck can be debilitating beyond only feeling stuck; having professional support as you work to change long-established thinking patterns can be tremendously freeing and liberating. Asking for assistance can be the most hopeful and powerful step you can take.

This moment is the first moment of the rest of your life. Are you willing to take the steps required to claim your happiness, success, fulfillment, and enlightenment? Will you take advantage of the opportunity to create a new reality for your life?

It's time to SHIFT and get prepared for what's coming up for your life… so I want you to put your heart and soul into paying close attention to how much mental, emotional and physical pain you are in. Then, step by step you can make the SHIFT gently, easily, and without having to deal with the mental and emotional pain and stress of not knowing what to do, not feeling your best, and all the other OLD WAYS that are holding you back.

I want your daily feeling of being overwhelmed to be replaced with a feeling of freedom throughout your day. I look forward to giving you the tools to help you conquer the every-day fears that hold you back. Here’s to living your dream life NOW.

There is no shame in asking for assistance to create happiness and success. If you have read the books, taken workshops, had psychic readings, taken prescriptions, and OTC drugs, etc. and still struggle; you might have emotional blocks preventing you from moving into your happiness and desires.

You might need to ask for assistance to clear out the self-doubt, fear, guilt, shame or unworthiness.

Here’s to living your dream life NOW.

There is no shame in asking for assistance to create happiness and success. If you have read the books, taken workshops, had psychic readings, taken prescriptions, and OTC drugs, etc. and still struggle; you might have emotional blocks preventing you from moving into your happiness and desires.

This is an investment in your health, happiness, success, fulfillment, and empowerment. Following the principles in this process will change your life forever and I want you to experience it yourself as soon as possible. Remember only you can take care of your happiness and mental, emotional, physical health and professional success.

You can do it! Call me if you need assistance to overcome any blocks or sabotaging behaviors!

For your convenience, I offer a 20-minute FREE no-obligation phone conversation to answer your questions and discuss how you can discover and create personal and professional success. http://drdorothy.net And you will receive value in the 20-minute conversation.

About Dr. Dorothy:

Dorothy M. Neddermeyer, Ph.D., Metaphysician – Certified Hypnosis and Deep Healing Practitioner, International Best Selling Author, and Speaker. Dr. Dorothy facilitates clearing blocks, fears, and limiting beliefs. You can live the life you desire. She brings awareness to concepts not typically obvious to one's thoughts and feelings. https://www.drdorothy.net

Reposted on Markethive by Jeffrey Sloe. Visit my Markethive site and sigup for FREE to receive 500 crypto coins.

Get Paid to subscribe

Get Paid to subscribe

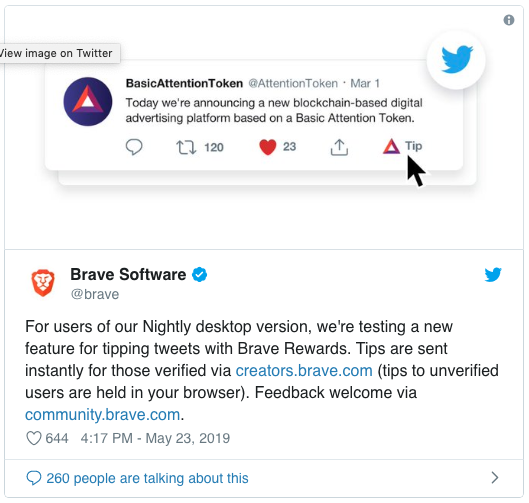

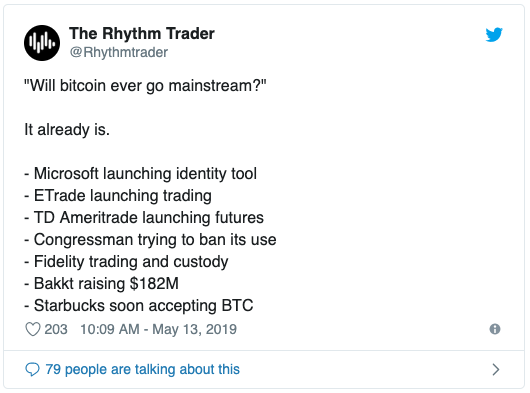

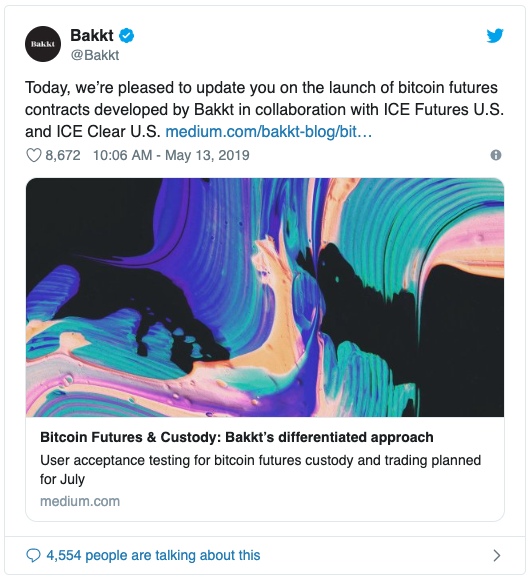

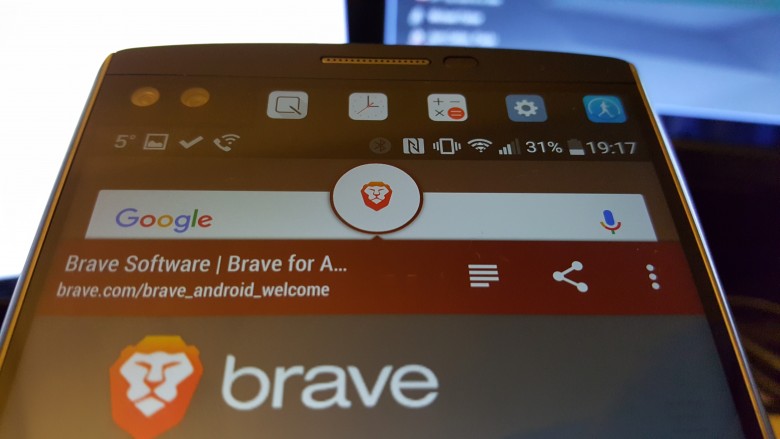

BAT: The Cryptocurrency that “Measures” How Popular Brave is

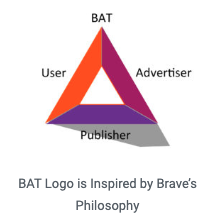

BAT: The Cryptocurrency that “Measures” How Popular Brave is To comply with its philosophy Brave Browser intends to use Basic Attention Token. This altcoin is very popular, not only because of its philosophy but also because it provides great profit opportunities for traders.

To comply with its philosophy Brave Browser intends to use Basic Attention Token. This altcoin is very popular, not only because of its philosophy but also because it provides great profit opportunities for traders.