Key factors hindering the Bitcoin bull run despite massive institutional buy

By Olivia Brooke – December 14, 2020

Market psychology implies that an increase in buying activities, in this case for Bitcoin, has the capacity to launch a price rally, but this is not forthcoming, and Bitcoin is still range-bound at $19,000, although Bitcoin is still teasing a breakout. The technical charts do not reflect the impact of institutional buy in the market and the bullish pressure is still building up ever so slowly.

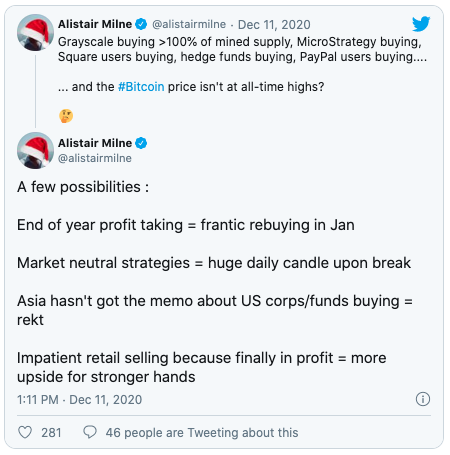

As usual, analysts and investors alike, have been paying close attention to this market trend and one analyst has proposed that few significant factors are behind this unusual market stagnation. First noting the sluggish pace at which the market is moving, Bitcoin entrepreneur and investor Alistair Milne shared from his Twitter handle, what the possible factors in play may be.

Investors are closing the year with eyes peeled for 2021

Institutional investors may be in the game of acquisition and holding, but independent traders and investors could be taking another strategic route. Cashing out and watching to key into an entry point in the following year is nothing new in the Bitcoin market.

This closing ritual is practiced among traders who are counting their profit and losses, making slight changes to their positions, and strategizing for new and promising zones in the following year. The pros and cons are similar; escaping the end of year pump or dump and the profit and losses that may follow.

A new year sometimes sees the market at new lows and “buy-the-dip” traders may enjoy this advantage if that happens. Neutral market strategies are also likely in play. The market is fundamentally moving sideways and despite the bullish market sentiments, Bitcoin remains a volatile asset, and market trends have the tendencies to make swift changes. On the condition that that is the case, neutral players could see losses at a minimal, while salvaging a fair share of gains, given that the market flips.

The Asian market is yet to catch up

Perhaps the Asian market is yet to make a grand entrance, this could be for many reasons, but lack of awareness of western market activities seems unlikely to be the case as the Asian market is usually very active, perhaps the late investment could be due to previous marginal trade made at a loss.

At this time, retail sellers are one of the weakest links in the market. Buying and selling for quick returns is the job of a retail seller, but in the long run, their customers are strengthening momentum and positioning for the perceived incoming market rally.

Clearly, the market is still in a sideways position, hence institutional buy not being enough to sway market dynamics. The new year will see strategic market activities and possibly usher in the gargantuan bull run.

DISCLAIMER

The views expressed in the article are wholly those of the author and do not represent those of, nor should they be attributed to, ZyCrypto. This article is not meant to give financial advice. Please carry out your own research before investing in any of the various cryptocurrencies available.

The original article written by Olivia Brooke and posted on ZyCrypto.com.

Article reposted on Markethive by Jeffrey Sloe