Is Bitcoin Poised to Break Out or Plunge Again?

(Mikhail Primakov2/Dreamstime)

By Bert Dohmen

By Bert Dohmen

Thursday, December 03, 2020 04:51 PM

Current | Bio | Archive

Once again, Bitcoin and other cryptocurrencies are all over the news. We have seen such periods for these digital currencies in the past, many of which ended in financial pain for the bulls. Will that be repeated now, or is something more bullish potentially ahead?

We have been correctly skeptical about this sector over the past three years. The charts show that was a good position. But the markets are dynamic, and of course, facts change.

Bullish or not, Bitcoin’s volatility is very high. It has doubled and halved in price over periods lasting just a few weeks.

Below is a weekly chart of the Bitcoin-U.S. dollar exchange rate over the past 4 years, highlighting the extreme price swings:

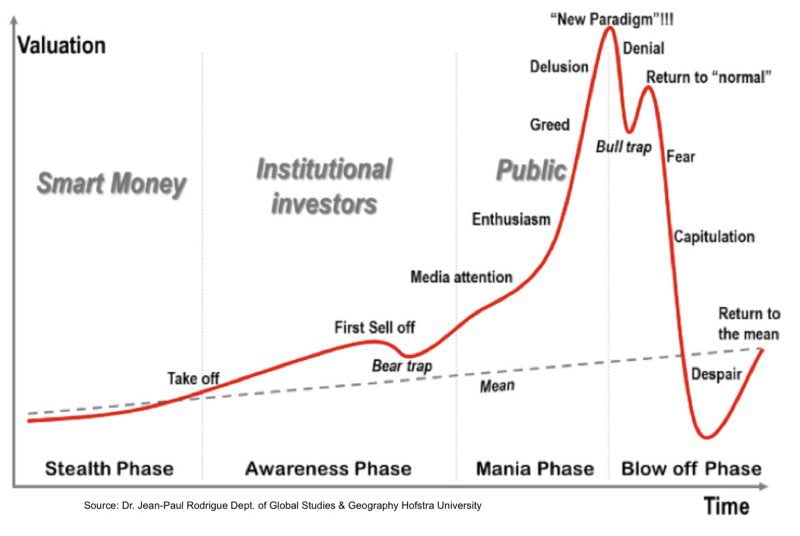

Cryptocurrencies in general plunged 75% to 100% from their euphoric highs in December 2017 to their lows just one year later. Bitcoin retreated from nearly $20,000 to below $3,200, depending on what market price is used. At that 2017 high, analysts in the financial media were hyping up these digital coins every day, forecasting rises to $50,000, $100,000, and even higher. Predictably, that euphoria marked the top.

Bitcoin then rallied sharply into the 2019 high, more than doubling in the span of a few months. But just when the hype hit its peak once again in June 2019, prices were slashed by 72% into the low of March 2020.

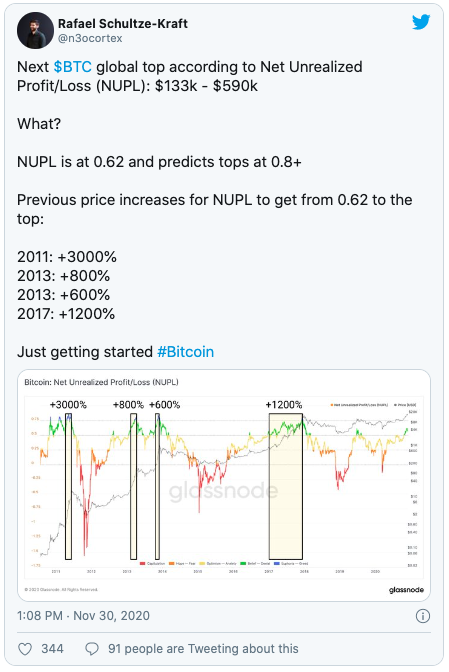

Since that point, Bitcoin has recovered its huge loss, and even rallied to slightly above the 2017 high.

Old highs are usually strong resistance. The further back in time, the stronger the resistance. The Bitcoin chart is now slightly above its 2017 high. If it reverses downward now, it would predict a sharp correction.

Once again, the wild forecasts of even $500,000 per Bitcoin are back in the media. To us, that is at least a near-term warning signal.

The Long-Term: At Dohmen Capital Research, we continuously reanalyze the various scenarios of different asset classes and market moves. Thus, we go back to the very long-term monthly chart, shown below. It is also a “log” chart, where the vertical price scale is logarithmic.

This long-term chart looks very bullish to us. $50,000 seems very possible. However, look at the huge declines, like the 81% plunge in 2018. Could you ride that out?

We also see some bullish long-term signs on a fundamental basis.

Several large institutions, including PayPal and Square, have taken out some sizeable positions. Of course, for them it is just a medium of payment, desired by many of their customers. The vast majority of asset managers, on the other hand, are skeptical.

High Regulatory Risks

Owning Bitcoin has been a speculator’s game up to this point. The government could impose regulations at any time, without warning, or shut them down. The U.S. Treasury Department is, after all, the only agency permitted to produce and distribute currency.

We have warned our members for years about the potential abuses in the cryptocurrency markets.

There have been numerous scams where investors lost everything. One founder of such a digital currency died, and he was the only one having the password to access the system. Some investors may have lost everything.

In October, the CFTC brought charges against BitMEX, said to be one of the largest cryptocurrency exchanges in the world. Supposedly, its transactions have been in excess of $1 trillion over the past few years, making over $1 billion for itself.

The inherent regulatory risks are likely one of the many reasons large asset managers have avoided exposure to the crypto sector. Now, however, we hear that very smart and successful hedge fund managers like Paul Tudor Jones, Stanely Druckenmiller, and even the managing director of Guggenheim, Scott Minerd, are putting sizable investments into this sector.

So, we ask, what do they know?

Central Bank Digital Currencies (CBDCs)

The following is conjecture on our part.

We see an increasing number of statements from central bank officials about using “central bank digital currencies,” or CBDCs for short. One said it would enable the central banks to inject stimulus directly into people’s bank accounts, a much more efficient way than sending out millions of checks as the government did this year.

We think CBDCs are inevitable, perhaps within the next two years.

Central banks don’t like competition. Therefore, they must find a way to extinguish other digital currencies. They could just declare them illegal. But that would unleash an uncomfortable backlash.

What to do? They could offer an exchange, a buyout of existing cryptocurrencies, or just Bitcoin far above market value. Everyone would be happy. Eliminating all the other digital currencies, many of which are not trustworthy, could also be justified to the public as an effort to protect investors.

Our point is that when something doesn’t make sense, such as very smart investment professionals who pay a lot for insider information entering a brand-new and high-risk sector, there has to be a reason.

Conclusion

We have written for the past several years that we don’t consider anything an investment if it can lose 30-50% of its value overnight.

However, the world is dynamic and evolves. When the facts change, it pays to change with them. We are not recommending the purchase of cryptocurrencies but there may be a time when we would accept it as a speculation. The fact that very knowledgeable and successful investors are now committing to Bitcoin is an interesting change.

At Dohmen Capital Research, the cryptocurrency markets are just one of the areas we cover in our analysis. In our award-winning Wellington Letter, we offer our more detailed contrarian insights on stocks, precious metals, the economy, and global financial markets.

Sign up for the Wellington Letter at 20% off today as part of our Extended Cyber Monday specials, along with our services for active stock and ETF traders. Click here to take advantage of these deals soon before they expire!

Bert Dohmen is a professional trader, investor, and analyst. As the founder of Dohmen Capital Research group and Dohmen Strategies, LLC, he has been giving his analysis and forecasts to traders and investors for over 43 years.

Advertisement

The original article written by Bert Dohmen and posted on Newsmax.com/Finance.

Article reposted on Markethive by Jeffrey Sloe

By

By