Your Guide to Avoiding Bitcoin Fraud

“Bitcoin is a remarkable cryptographic achievement. The ability to create something which is not duplicable in the digital world has enormous value. The Bitcoin architecture, literally the ability to having these ledgers that can’t be replicated is an amazing advancement.” – Eric Schmidt, Executive Chairman of Google,March 2014.

With Bitcoin price increasing over the years and reaching billions of dollars in market capitalization, all kinds of people see its value and appeal. This brings out both the good and bad in human nature.

Unfortunately, with the bad comes scammers. The bottom line is scammers also want to profit somehow from Bitcoin, but through nefarious means. This typically involves targeting unprepared victims, who end up losing their Bitcoin as a result.

In this guide we will walk you through the most common Bitcoin scams. We’ll show you how to spot them, and make sure you don’t become the next victim.

Fake Bitcoin Exchanges

Often on social media you’ll see a link saying something like “Buy bitcoin for 5% under market value. Save big!” This is a marketing trick to get you to visit and use their fake exchange.

If you visit any exchange site the very first thing you want to do is make sure it’s HTTPS secured and not HTTP. This means that the web traffic is encrypted and secured; if it’s just HTTP without the “S” that is a big red flag and means stay away.

Another red flag to look out for are fake exchanges that offer selling Bitcoin for PayPal. On these sites you’ll see a web form to enter your PayPal email and amount to sell. After submitting, you will be presented with a QR code to send your bitcoin to. But the money never arrives.

Most of these fake exchanges are here one day and gone the next. You will see them pop up but will quickly disappear, and then re-emerge with a different domain name later.

To be sure you are going to a real Bitcoin exchange, visit our exchange portal on Bitcoin.com to ensure you aren’t being scammed.

Fake Bitcoin Wallets

Spotting fake Bitcoin wallets is a bit tougher, because wallets primarily are about storing bitcoin and not buying or selling it. It has less to do with money than it does with the software you may use. Typically, fake Bitcoin wallets are just scams for malware to infect your machine in order to steal your passwords or private keys.

Just like with fake Bitcoin exchange sites, you should trust your instincts and look for red flags. Does the wallet site use HTTPS? Is the name of the wallet site trying to resemble another reputable Bitcoin wallet by impersonating it? Outside of the obvious, it may be hard to tell if a wallet is fake. A good practice is to ask your peers if someone has used the wallet before. You can do this on the Bitcoin Forum or Bitcoin Reddit.

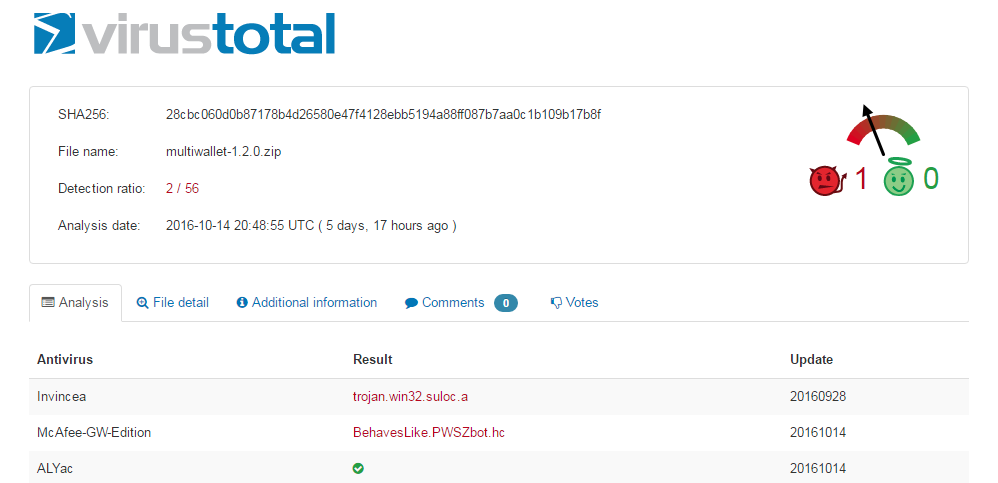

If the wallet is a downloadable client, another good practice is to check the site for malware. Sites like VirusTotal are a great resource for checking executables to see if they contain viruses.

To be sure you are going to a real Bitcoin wallet, visit our wallet portal on Bitcoin.com to ensure you aren’t being scammed.

Phishing Scams

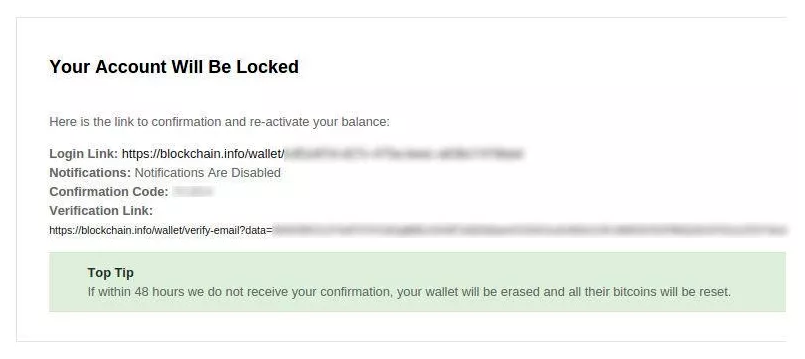

This is a very common scam. Phishing is when someone tries to trick you into thinking they are a trusted company or website by having you visit a fake site.

Typically, phishers contact you via email or through a fake web advertisement. The end result is you go to their website by mistake and either get malware, or lose your bitcoin through a fake sale.

With emails you have to be careful to not take the bait. You may receive an email from a wallet or exchange you already use, either by coincidence or through past database hacks. Maybe hackers obtained your email address on the black market; for example from a Yahoo! or other service hack.

Best practice is to not click on any hyperlinks in an email or open attachments. Go directly to the website if you have to do business there. A common tactic is to make a hyperlink look real, but if you hover over it you will see the fake website URL. Always check the sender email to see where it’s coming from (although this is not 100% reliable as emails can be spoofed).

With fake web advertisements, you have to be careful on the site you are visiting. This usually happens when searching on the web for things like “blockchain.” The top result could actually be an advert via Google for example, but may end up being a fake Bitcoin wallet. Best practice is to not visit sponsored ad content in search results, and just manually type the real website address directly into your browser.

To be sure you are going to a real Bitcoin wallet, visit our wallet portal on Bitcoin.com to ensure you aren’t being scammed.

Ponzi Scams

Ponzi scams are promises from websites that you will “double your bitcoin” overnight, or some similar outlandish claim. Ponzi sites may be harder to spot, but they’re easy to figure out once you understand this: the only way to double your money is to first send it to them.

Ponzi sites also typically have referral programs, so if you get others to sign up for the site by visiting your affiliate link, you may make a few cents. This is another red flag, as many times you will see on social media shared links with referrals within the URL. Usually it will look something like this (referral link is in bold): domain.com/ponzi/?ref=12345

If you’re unsure whether this Bitcoin site is a scam, visit our Scam thread on the Bitcoin Forum to see if others have used it before.

Cloud Mining Scams

This can be a bit tricky because not all cloud mining operations are scams. Some are completely legitimate, however many are scams, so it’s best to warn people (especially newcomers) to be careful when looking into cloud mining.

Cloud mining is shared mining hashpower, where people pool their funds together to rent Bitcoin mining machines. For legitimate operations, this works and can be profitable. For scams, returns may be low or non-existent. As we’ve established above, it’s best to trust your instincts and look for red flags.

Does the site use HTTPS? Did you find the site from a referral link on social media? Does the cloud mining operation not give any insight into what pool they use to mine, or let you select the pool you want to direct your hashrate to? These are just a few things to look for; you can read some other tips here.

If you’re unsure whether a certain Bitcoin site is a scam or not, visit our Bitcoin Mining Forum and ask someone for help and/or their opinion to ensure you aren’t being scammed.

Original article posted on the Bitcoin.com site.

Article re-posted on Markethive by Jeffrey Sloe