Why The Post-Halving Miner Capitulation That’s Underway May Ignite A Meteoric Bitcoin Rally

By Brenda Ngari – May 26, 2020

Bitcoin miners have been on a wild roller-coaster ride in the past few weeks. After the halving on May 11, the rewards they receive were slashed by half from 12.5 BTC per block to 6.25 BTC. As a result, most of the miners using older model mining machines were forced to shut them down as they were registering meager profits. This resulted in a substantial drop in the hashrate.

With bitcoin recently slipping below crucial $9,000 level, fears of a further dive have been renewed. A possible sell-off might discourage new investors from entering the bitcoin market. However, Charles Edwards, a digital asset manager at Capriole, sees the miner capitulation as an opportune time to buy bitcoin at low prices before the next bull market.

An ‘Almost Vertical’ Rally Could Spring From Ongoing Miner Capitulation

According to an indicator known as hash ribbons, miner capitulation has started. As miners capitulate, they sell their bitcoin holdings to cover their expenses and cut their losses. This process adds significant pressure to the bitcoin market.

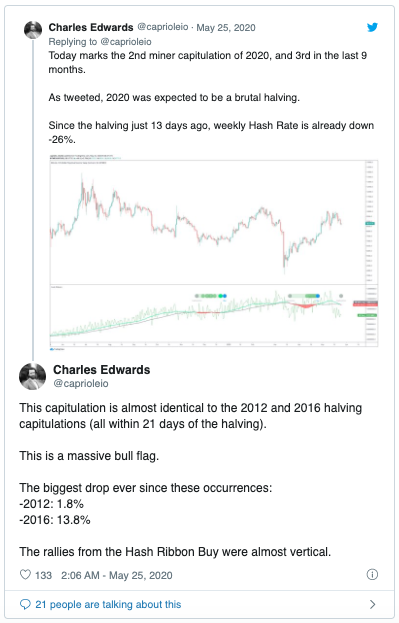

In a tweet on May 25, Charles Edwards pointed out that the second round of miner capitulation in 2020 is currently underway, indicating that BTC could continue slumping in the near-term.

Edwards had noted earlier that BTC’s third halving that just concluded would be a brutal event for miners. Less than two weeks since the event, bitcoin’s weekly hashrate has dropped by 26%. Notably, a similar pattern was witnessed after the two previous halvings in 2012 and 2016 as miner capitulation began within 21 days of the halving.

The silver lining of the current picture is that miner capitulation is often a “massive bull flag” – a continuation pattern of a bullish trend. In fact, Edwards cites that the rallies that ensued after miner capitulation were “almost vertical”.

Edwards did not explain how high bitcoin could go after a miner capitulation. He had, however, stated in late December last year that bitcoin historically saw an average gain-to-cycle-peak of over 5000%.

Strong Fundamentals Boost Bitcoin’s Bullish Outlook

Charles Edwards further noted that bitcoin’s bullish case is bolstered by the strong fundamentals.

He gave three factors to back his assertion: massive increases in Tether (USDT), funds are hungry for bitcoin as they buy all the newly-minted BTC in 2020, and the overall macro picture against a backdrop of BTC’s halved inflation rate. The latter, in particular, is presumably in regard to the expansive monetary measures undertaken by central banks across the globe as a result of the COVID-19 pandemic.

Edwards observed that the hash ribbon buy signal could be confirmed in less than three weeks. This could very well be the last chance to accumulate BTC before the asset starts soaring into the stratosphere.

DISCLAIMER

The views expressed in the article are wholly those of the author and do not represent those of, nor should they be attributed to, ZyCrypto. This article is not meant to give financial advice. Please carry out your own research before investing in any of the various cryptocurrencies available.

The original article written by Brenda Ngari and posted on ZyCrypto.com.

Article reposted on Markethive by Jeffrey Sloe