Bitcoin (BTC) To $90,000 in 2020 Forecasts German Bank Report

After Retaking $8,000, Bitcoin to Recover Further

Germany’s seventh-largest financial institution, Bayern LB, published a report on bitcoin predicting a price of $90,000 next year.

Basing its prediction on stock-to-flow ratios, it states that bitcoin “digital gold” is a “harder” form of commodity money than gold.

Part of a series of reports on digital megatrends, subtitled “Is bitcoin outshining gold”, the report states:

“Applied to Bitcoin, an unusually strong correlation emerges between the market value of this cryptocurrency and the ratio between existing stockpiles of Bitcoin (‘stock’) and new supply (‘flow’).”

Although the bank’s analysts are quick to say caution should be the watchword when applying this model to bitcoin, it thinks it is nevertheless a useful approach.

Bayern LB concludes that taking this practical approach yields useful insights into how bitcoin should be valued.

“It becomes clear that Bitcoin is designed as an ultra-hard type of money. Next year, it will already exhibit a similarly high degree of hardness as gold. In 2024 (when halving is set to take place again), Bitcoin’s degree of hardness will again increase massively,” the report reads.

Gold developed its “hardness” over millennia while bitcoin has achieved similar properties through “supply engineering”, namely the protocol designed by Sataoshi Nakamoto.

The yellow metal is currently priced at $1,491 having pulled back from highs at $1,537 – its highest valuation since April 2013.

Bitcoin has returned 122% year to date and gold 16%.

Gold did it the hard way but bitcoin is not ‘cheating’

The report notes how gold earned its high stock-to-flow ratio the “hard way”:

“Moreover, there have been no shortcuts for the yellow metal: a higher stockpile could only have accumulated in a shorter space of time if it had been easier to mine gold. In that case, however, gold would not have qualified as a store of value and, in turn, nobody would have held the yellow metal.”

Because of its supply engineering bitcoin will be able to emulate and even surpass gold’s stock-to-flow ratio.

Stock-to-flow of course relates to scarcity, and with bitcoin’s addition of the difficulty adjustment mechanism the inventor was able to disconnect price from flow (supply), thereby making supply deterministic.

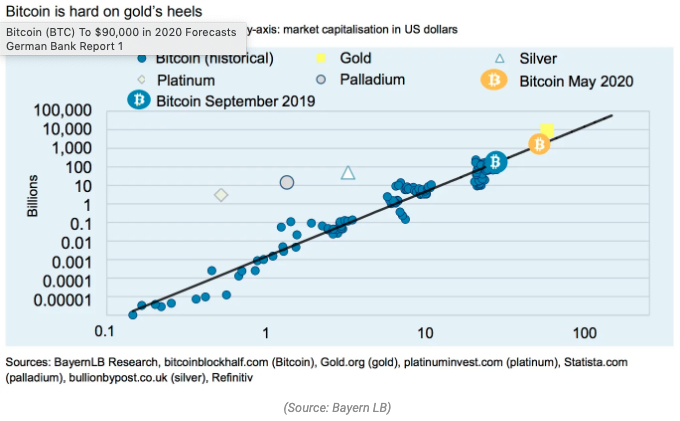

Using regression analysis Bayern LB plots a market capitalisation that is creeping up on gold by 2020 when the next halving takes place.

On this basis a price of $90,000 is postulated for next year, which indicates that bitcoin is massively undervalued.

“If the May 2020 stock-to-flow ratio for Bitcoin is factored into the model, a vertiginous price of around USD 90,000 emerges.”

But as the author(s) conclude, even the best statistical model can fall apart, so the report comes with a big dollop of Caveat Emptor.

Bayern LB (Bayerische Landesbank ) is one of Germany’s six state banks. It is 75% owned by the state of Bavaria and has a €220 billion balance sheet.

The full report is available here.

Original article posted on the EthereumWorldNews.com site, by Gary McFarlane.