Millions Out of Work: Weekly Jobless Claims Soar Amid Pandemic

More than 3 million Americans file for unemployment as the coronavirus pandemic brings the economy to an unprecedented standstill.

M. COREY GOLDMAN • UPDATED:MAR 26, 2020 9:49 AM EDT • ORIGINAL:MAR 26, 2020

Image © courtesy of abc12.com

More than 3.3 million Americans are out of work and have filed for jobless claims, an unheard of number never before recorded in the United States, as the onslaught of the deadly coronavirus brings the U.S. economy to an unprecedented standstill.

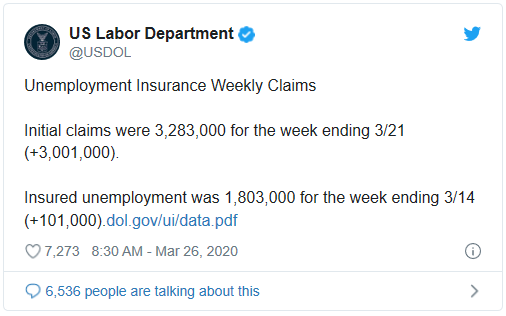

The U.S. Labor Department reported on Thursday that jobless claims for the week ended March 21 tallied 3.283 million, an astronomical number considering the working population of the United States.

Economists surveyed by Econoday had expected 1 million jobless claims for a week that saw wide shutdowns in recreation, food services and manufacturing because of the coronavirus outbreak. The last record weekly number was 695,000 set in 1982.

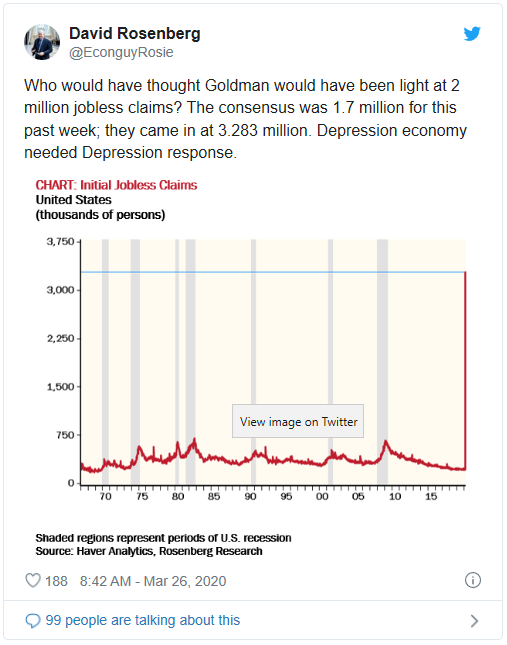

"Depression economy needed Depression response," David Rosenberg, chief economist of Rosenberg Research, wrote on Twitter, noting in awe that the number was even higher than Goldman Sachs's dire 2-million-plus prediction.

Goldman Sachs economist David Choi a week ago said he saw initial claims for the week ended March 21 jumping to a seasonally adjusted 2.25 million.

Jobless claims the week prior numbered 281,000. Forecasts in a Reuters poll ranged from 250,000 claims up to 4 million for the week.

Jobless claims across the U.S. soared as the coronavirus pandemic prompted widespread shutdowns of commerce and industry, and layoffs with it, but it's going to get significantly worse, economists say.

Until March, U.S. employers had added jobs for a record 113 straight months, causing payrolls to grow by 22 million, pushing the jobless rate to 3.5% in February, a near-record level not seen since the 1960s.

The largest increases in initial claims for the week ending March 14 were in California (+14,221), Washington (+7,624), Nevada (+4,047), Pennsylvania (+3,212), and Massachusetts (+2,737), while the largest decreases were in Arkansas (-461), Alabama (-341), Puerto Rico (-171), West Virginia (-168), and Maine (-81), the Labor Department said.

The surreal numbers follow the Trump administration's ask that states hold back from releasing their own unemployment-claims figures prior to the publication of the national numbers each Thursday – a move meant to keep the headline-grabbing numbers contained for now.

They also come ahead of the U.S. government's record $2.2 trillion stimulus plan to give American families and businesses a financial shield against the ravages of the coronavirus pandemic.

"The real question at hand now is if the current stimulus package is enough to give Americans the support they need," said Mike Loewengart, Managing Director, Investment Strategy with E*TRADE Financial.

"This environment is no doubt taking a toll on the consumer, a critical driver of economic health, and crunching profitability of small and big businesses alike."

The original article written by M. Corey Goldman and posted on thestreet.com.

Article reposted on Markethive by Jeffrey Sloe