Can AT&T's New TV Service Stem Its Subscriber Losses?

AT&T TV is now available nationwide — who's subscribing?

Adam Levy

Adam Levy

(TMFnCaffeine)

Mar 8, 2020 at 9:29AM

AT&T's (NYSE:T) TV business lost a total of 4.1 million subscribers last year between its three products: DirecTV, U-Verse, and AT&T TV Now. While losses peaked in the third quarter, as management promised, the number of cancellations in the fourth quarter still came in higher than anticipated.

In order to stem those losses, AT&T's going all in on streaming video. Its new video service, AT&T TV, streams linear TV channels over the internet to a custom-built set-top box. AT&T TV also has an app for connected TV devices, tablets, and smartphones. Combined with HBO Max, which launches in a couple of months, streaming will be the "workhorse" that drives AT&T's television business going forward.

The new linear TV service launched this month, but there are still a few question marks about its ability to stem AT&T's subscriber losses.

The AT&T TV set-top box and remote. Image source: AT&T.

Reruns on TV

AT&T TV's set-top box is the company's equivalent of Comcast's (NASDAQ:CMCSA) X1 platform. Comcast has had a lot of success with X1. The rollout of Comcast's X1 set-top box to the majority of its video subscribers certainly helped it lose fewer subscribers than the rest of the industry for a couple of years.

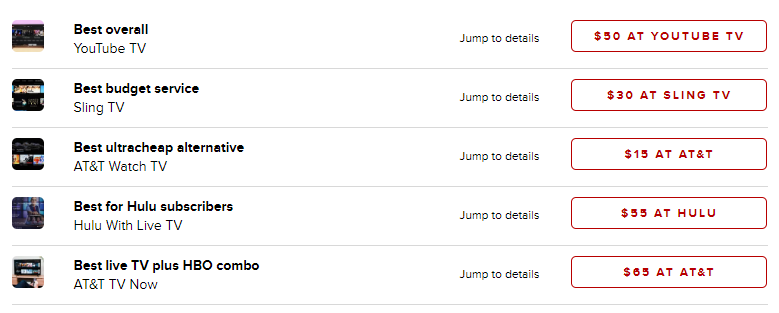

But Comcast's management expects the tide to turn next year as it focuses more on profitability. Interestingly, that's a key selling point to investors when AT&T's management talks about AT&T TV Now. Since there's no satellite installation or in-home equipment requiring a professional to set up, AT&T's customer acquisition costs for the new service are considerably lower than DirecTV. Additionally, creating a unified back-end for AT&T TV and HBO Max will help reduce spending on technology in the long run, further improving profitability.

AT&T saw its entertainment segments' profit margins improve in 2019, as many video subscribers came off promotional pricing. (That also led to substantial subscriber losses.) By shifting more customers to AT&T TV, management expects to see continued margin expansion in 2020 and 2021.

Focusing on profit margins for the new service may ultimately result in lower uptake than investors are hoping for. Management's primarily focused on the 20 million or so households it passes with its fiber network, which enables gigabit-speed internet. That's only a small portion of households for a product that AT&T is technically capable of delivering anywhere in the country, so subscriber gains could be limited. That said, those will likely be the most profitable households for AT&T.

AT&T TV doesn't fix the biggest pain points of traditional TV

While AT&T TV might be an improvement in user experience from DirecTV and have better channel selection and more options than AT&T TV Now, AT&T isn't solving the biggest pain point of the traditional TV industry. Consumers want fair and transparent pricing; AT&T's pricing for AT&T TV is anything but.

AT&T requires customers to sign up for a two-year contract. In the first year, the video service is priced substantially lower than in the second year, but consumers would have to dig through the fine print to see exactly how much their bill will go up in year two. If consumers want out of the contract, they'll have to pay an early termination fee. And if they want more than one set-top box, they'll have to pay a fee for that. There's also an activation fee.

What's more, regular AT&T TV pricing is about the same price as DirecTV, but subscribers typically receive fewer channels on comparably priced packages. When AT&T took channels out of its AT&T TV bundle and raised prices, it didn't attract too many new subscribers.

Instead of using its lower-cost television platform to reach a broader audience and reduce its pricing, AT&T is heavily focused on profits. That means the product likely won't do a very good job of attracting consumers back to pay-TV, and it might not even be enough to retain existing subscribers. Subscriber losses will continue for AT&T, but profit margins will expand. In the long run, that could end up costing AT&T, however, as a slightly larger profit margin on a significantly smaller customer and revenue base means a smaller bottom line.

Author Bio

Adam has been writing for The Motley Fool since 2012 covering consumer goods and technology companies. He consumes copious cups of coffee, and he loves alliteration. He spends about as much time thinking about Facebook and Twitter's businesses as he does using their products. For some lighthearted stock commentary and occasional St. Louis Cardinals mania … Follow @admlvy

Original article posted on the Fool.com site, by Adam Levy.

Article re-posted on Markethive by Jeffrey Sloe