How Zero Interest Rates in the US Will Impact Stablecoin Adoption

Image courtesy of CoinTelegraph

Opinion APR 14, 2020

Opinion APR 14, 2020

We are living through interesting times. At the time of writing, roughly half of the world's population is on lockdown, with 90 countries in various forms of confinement and the pandemic crashing global stock markets.

Although we've seen some relief in certain parts of the world, the pandemic is far from over, and there is a tangible fear of a possible global recession. While several easing measures have been adopted by the world's banks to contain the worst of the economic damage, the pandemic has created a perfect environment for crypto.

However, the new measures currently being taken by the banks may also create new challenges. There has been increasing concern from both the traditional and crypto markets about the effects that negative interest rates in the United States will have on the economy. In fact, Bitcoin (BTC) whale numbers have hit a two-year high as fear-selling has created a mirror image of 2016 market conditions. But where does this leave the stablecoin market and its business model?

Related: Looking Into the History of Stablecoins to Understand the Future of Money

Stablecoin adoption

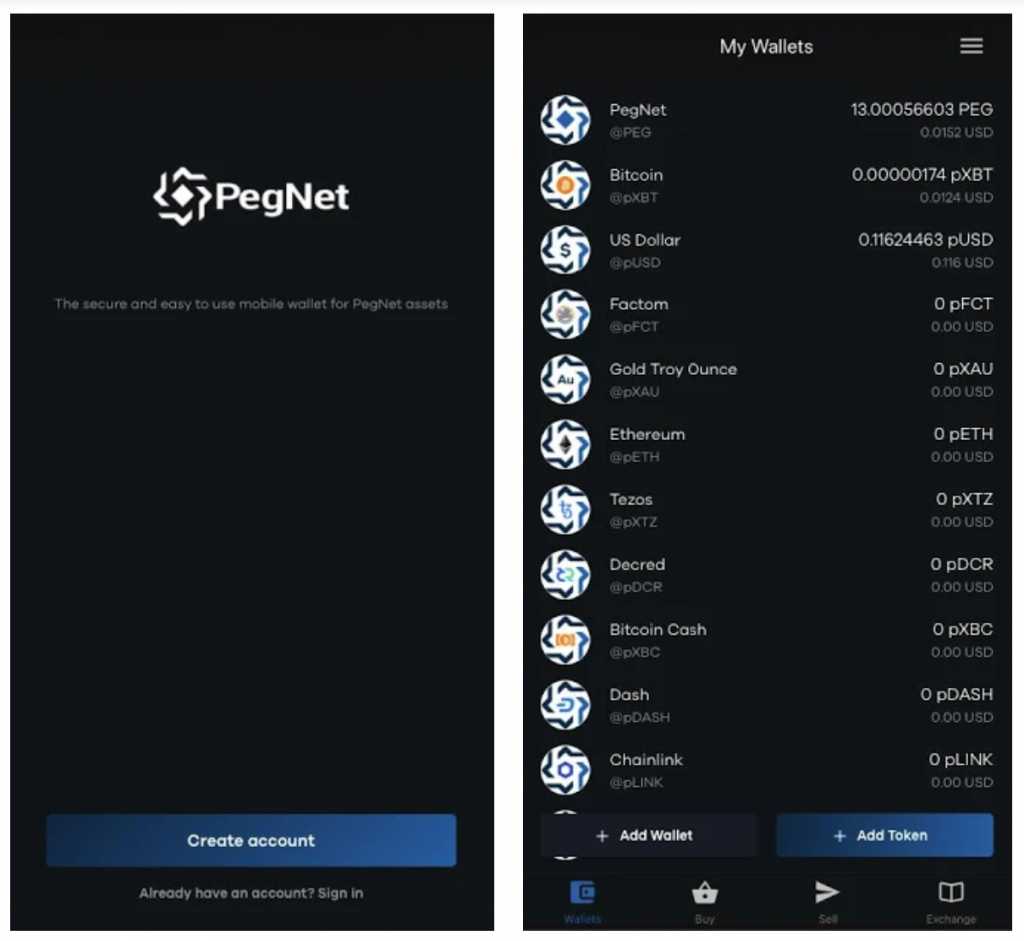

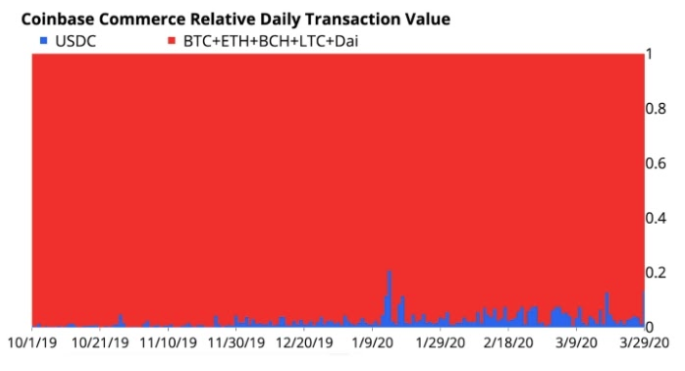

As with all forms of digital currency, popularity and adoption depend on how the currency stores its value and its means of payment. From USD Coin (USDC) to Facebook's Libra, the rise of stablecoins can be accredited to their attractiveness as payment methods.

They have a global reach, low costs and no delays. They can also be embedded in digital applications or integrated into customer relationship management platforms due to their open architecture. They have also proved to be safe from the very popular data-hog crypto-mining malware.

At the moment, most stablecoin claims get delivered to the issuing institution or its known underlying assets with face value redemption guarantees. For example, a coin bought for one U.S. dollar may be redeemed for an actual U.S. dollar, but there is no government backing involved.

The U.S. government has rushed to the defense of American small businesses, pledging nearly $600 billion in loans as part of its Paycheck Protection Program. But many financial technology lenders have struggled to secure loans through the program.

Some businesses may make it through the application process, but a simple business loan calculation shows they would still be cash strapped in a matter of months. This doesn't take into account the fact that the dollar would be devalued, lowering the relative value of any cash reserves. Stablecoin investments, on the other hand, should deliver high yields of interest if invested properly.

Trust is created by the issuance of safe assets against any stablecoins, and the settlement technology is usually based on a blockchain model. But its biggest attraction by far is the promise from networks to make transacting an integrated and social experience, as most of the models are designed by companies that have a user-centric approach.

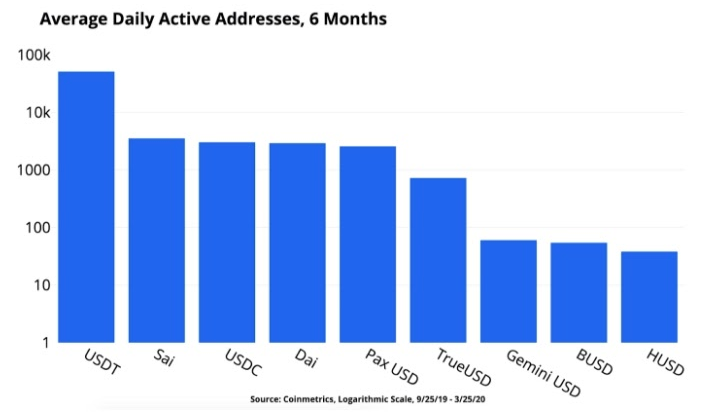

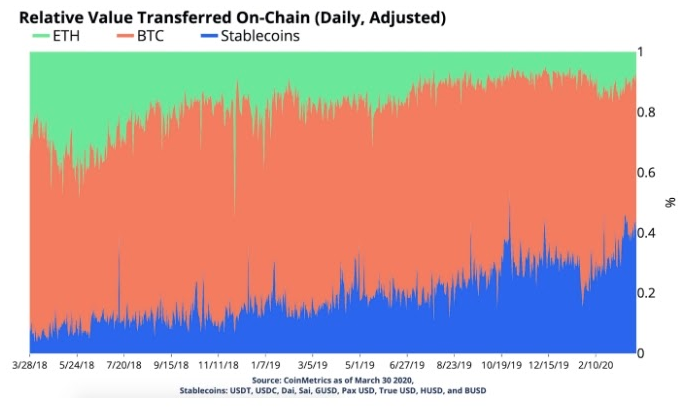

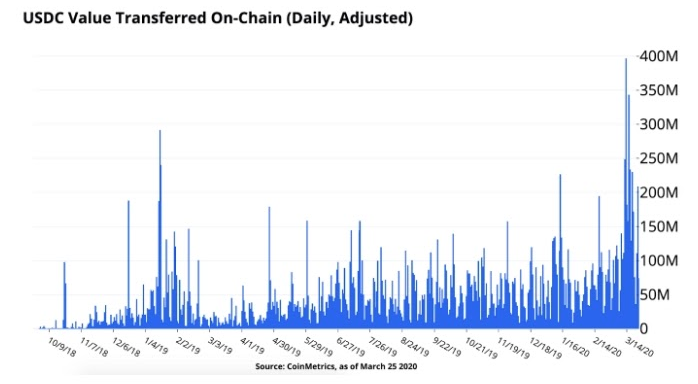

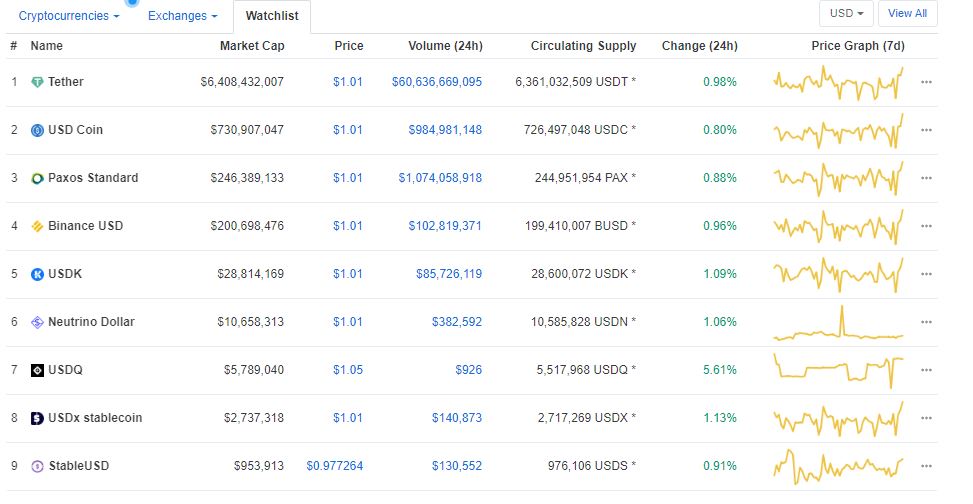

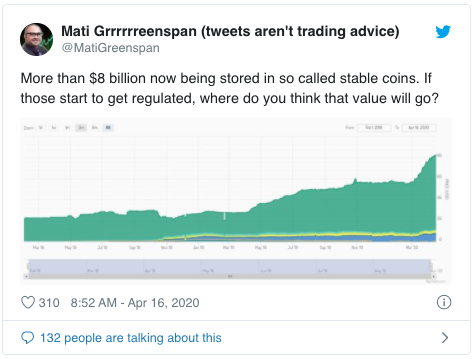

With organizations bracing for cryptojacking and the pandemic currently encroaching on all the financial markets, Coin Metrics's "State of the Network" report has shown clear indications of spectacular growth in the supply of all stablecoins, growing its market share at the time COVID-19's impact on global markets started to become visible.

Looking at interest rates, stablecoins and the dollar

The dollar has always been seen as one of the safer currencies during troublesome times, as the recent market anxiety led by COVID-19 goes to show. Just as businesses want predictable revenue so that they can plan for the future, investors want a safe bet when it comes to their investments.

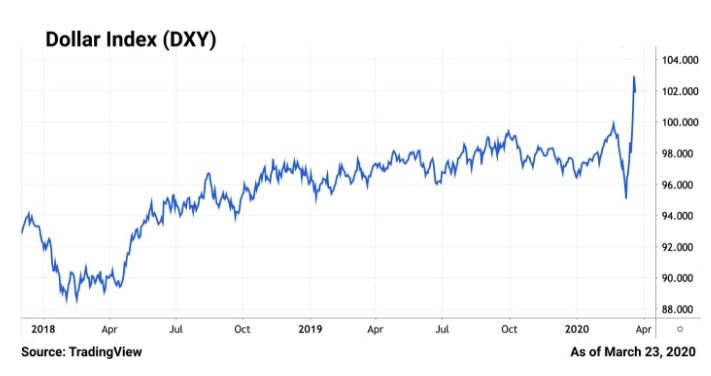

As panic started to make itself known, the dollar index grew from 94 handles to around 103 at the peak of the sell-off. The same movement can be seen when it comes to stablecoins. As the market started crumbling, U.S. dollar-pegged stablecoins such as USDC and Tether (USDT) were seen as safer crypto assets as compared to other cryptocurrencies.

As of March, the market capitalization of the biggest stablecoins has grown significantly. U.S. dollar-pegged stablecoins are linked to the demand of dollars by nature, and we cannot ignore the market's view on the greenback or the Federal Reserve's stance on interest rates when looking at their overall position in the financial sphere.

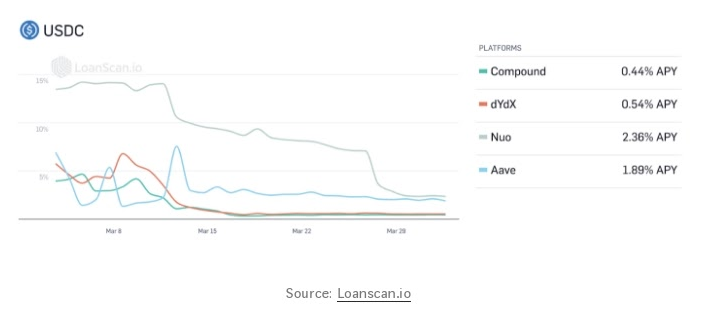

One of the biggest sources of revenue for stablecoin users has been the interest generated by stablecoin funds deposited into their traditional bank accounts by stablecoin issuers. As the Fed has cut its benchmark rates to 0.25% in light of the pandemic, banks will also lower their percentage yields on saving accounts to match the Fed's move, leading to less income for stablecoin users.

If the rate goes any lower, like we've seen in Europe and Japan, stablecoin users will definitely be affected.

Stablecoins will continue to flourish

The current low interest rates may trigger some stablecoin users to start collecting fees in some way or form or to pursue other crypto avenues, but stablecoin issuers will not be left out to dry. In fact, it may benefit them in new ways. Institutional interest, especially in the security transaction and money movement areas, is flourishing.

Several of the major investment banks are stepping up to take advantage of blockchain technologies, chief among them JPM Coin of JPMorgan Chase. To brighten the light at the end of the tunnel, it is not only the giants in the banking industry that want to take advantage of the technology, but the smaller central banks have also shown growing interest.

The People's Bank of China is close to finalizing its central bank digital currency, or digital yuan, and according to reports the central bank believes that its digital currency will be "a convenient tool for its zero and negative interest rate." At the same time, the Fed, the European Central Bank, the Bank of England and the Bank of Japan are also stepping up their efforts in this area.

Even though digital bank currencies and stablecoins do not work the same way, the growing awareness of blockchain and the technology's disruptive nature could lead to fantastic collaborations. This could also boost trust levels among consumers since many of them still feel that stablecoins, like most cryptocurrencies, could easily serve as an enabler of their online privacy.

The decentralized finance and open finance movements can also be significant in the future growth of stablecoins. With rising national debts, demand for a U.S.-dollar centralized collateral within the DeFi system has been growing.

According to Paolo Ardoino, the Chief Technology Officer of Tether, "You cannot have algorithmic stablecoins relying only on the crypto-assets themselves." Ardoino continued to state that centralized collateral of the U.S. dollar could provide a "safe set of shoulders" to the DeFi ecosystem. It may be worth our while to keep an eye on these developments.

Conclusion

Our current low interest climate may leave stablecoin users at a loss when it comes to managing their assets, but it should be seen in a positive light. When looking at the bigger picture, the concept of the "stablecoin" has established itself as an essential part of the crypto space, and its importance will continue to expand going forward.

Individual investors may find that stablecoins provide safety when we experience harsher market conditions. Investment options within the stablecoin space can always be reevaluated by traders and investors alike when the market becomes more competitive again.

The views, thoughts and opinions expressed here are the author's alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Markethive Advertisement

Original article posted on the CoinTelegraph.com site, by Sam Bocetta.

Article re-posted on Markethive by Jeffrey Sloe