Here’s Why Ripple Is Dumping One-Third Of Its Stake In MoneyGram

By Brenda Ngari – November 28, 2020

Blockchain-based payment firm Ripple is selling a third of its position in MoneyGram, the remittance giant that provides liquidity to its XRP settlement service, according to details of a new filing. This represents the very first sale of MoneyGram’s stake since the two companies entered into a strategic partnership last year.

Per a filing with the United States Securities and Exchange Commission (SEC) on Nov.27, Ripple currently owns 6.22 million shares of MoneyGram or 8.6% of shares outstanding. The fintech firm also has a warrant to purchase another 5.95 million shares for an equity position that amounts to 12.2 million shares (equivalent to 17% of MoneyGram’s shares outstanding).

Ripple informed the SEC that it is now selling roughly 4 million MoneyGram shares. This is 33.3% of its entire stake in the remittance company if you include the shares represented by the warrant.

Why The Sell-Off?

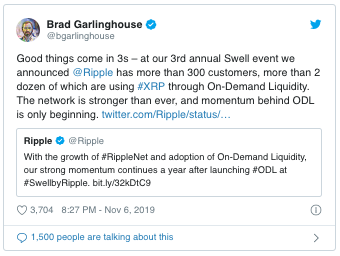

When Ripple invested an initial $30 million into MoneyGram in June last year, the firm acquired a stake in MoneyGram. Upon entering the partnership, MoneyGram agreed to use Ripple’s xRapid product (now known as the On-Demand Liquidity) and also the XRP cryptocurrency to facilitate cross-border payments.

In exchange, Ripple purchased MoneyGram shares at an average purchase price of $4.10 apiece — a massive premium at the prices then. Fortunately, MoneyGram shares have surged by over 250% this year and closed at around $7.41 on November 25. This means that Ripple has raked in millions of dollars from its MoneyGram investment.

According to a spokesman for Ripple, the sales — which are still ongoing — are “purely a judicial decision to realize some gains” on the firm’s investment in MoneyGram and are not necessarily indicative of the present state of the partnership between the two companies.

When the sale is concluded, Ripple will still own 3.22 million shares — or 4.44% of MoneyGram. If you count the shares represented by the warrant, Ripple will still own at least 11% of the payments processor.

Ripple completed the promised $50 million investment in MoneyGram with an additional $30 million in November 2019. MoneyGram uses Ripple’s tech to facilitate cross-border transfers in at least four countries. The Texas-based firm has also received payments of over $52 million from Ripple for providing liquidity to Ripple’s On-Demand Liquidity network.

DISCLAIMER

The views expressed in the article are wholly those of the author and do not represent those of, nor should they be attributed to, ZyCrypto. This article is not meant to give financial advice. Please carry out your own research before investing in any of the various cryptocurrencies available.

The original article written by Brenda Ngari and posted on ZyCrypto.com.

Article reposted on Markethive by Jeffrey Sloe