Report: Expect Ethereum To Lose the #2 Spot to Tether (USDT) in 2021

John P. Njui • THEREUM (ETH) NEWS • DEFI • OCTOBER 9, 2020

Quick take:

- The team at Bloomberg has predicted that Ethereum could lose the number 2 spot to Tether (USDT) by next year

- Increasing demand and adoption of stablecoins is the major force behind Tether’s rise

- Stablecoins are a precursor of CBDCs and will most likely be more enduring than altcoins

- Ethereum has had a relatively stagnant market cap since 2017 when compared to Tether

The team at Bloomberg has released the October crypto outlook report in which they predict that Tether (USDT) will most likely edge out Ethereum from the number two spot according to market capitalization.

The report explains that there is a growing demand for both Bitcoin and crypto-assets that resemble the dollar. If this trend prevails, USDT will definitely continue to grow. Additionally, the increased adoption of stable coins is also a strong signal that Central Bank Digital Currencies will be launched in the near future.

Expect Bitcoin #1, Tether #2 in 2021 If Trends Remain the Same.

Indicating demand for a digital version of gold (Bitcoin) and a crypto-asset like the dollar, if current trends prevail, the market cap of Tether may surpass Ethereum next year.

Increasing adoption of stable coins is likely a precursor for central bank digital currencies and promises to be more enduring than alt-coin speculative excesses. The rapid rise in the market cap of stable coins indicates that central bank digital currencies (CBDCs) are a matter of time, in our view.

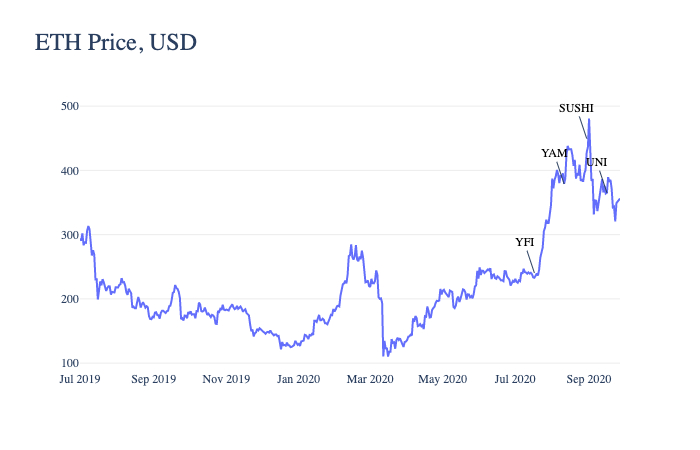

Ethereum’s Market Cap has Stagnated Since 2017

With respect to the popularity of the stablecoin of Tether (USDT), the report went on to explain that it would take a mega event to halt the increasing adoption of Tether which is on a path to edge out Ethereum in terms of market cap.

Furthermore, ETH’s market cap has more or less stagnated since 2017 thus providing Tether with an opportunity to take the number 2 spot.

It should take something significant to stall the increasing adoption of Tether, the top stable coin, which ison pace to match the capitalization of Ethereum in a bit less than a year, based on the regression trend since the start of 2019.

Our chart depicts the stagnant market cap of Ethereum since 2017 vs. rapidly rising Tether, which jumped to a new high of almost $16 billion at the start of October.

Original article posted on the EthereumWorldNews.com site, by John P. Njui.

Article re-posted on Markethive by Jeffrey Sloe