DeFi craze propels Uniswap monthly volume to $15.3B, surpassing Coinbase

Uniswap processed $15.3 billion in monthly volume in September, outpacing Coinbase and signalling that DeFi is here to stay.

Image courtesy of CoinTelegraph

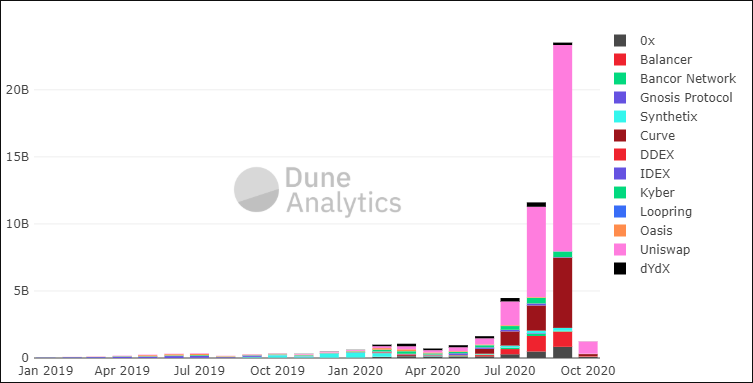

Data from Dune Analytics shows that in the month of September Uniswap decentralized exchange processed $15.371 billion in volume. In the same period, reports indicate that Coinbase processed $13.6 billion.

Monthly decentralized exchange volume. Source: Dune Analytics

The significant spike in Uniswap’s volume can be attributed to two major factors. First, the explosive growth of decentralized finance (DeFi) and yield farming of governance tokens caused decentralized exchanges to thrive. Second, the launch of Uniswap’s governance token UNI led to a frenzy on the platform.

June marked the start of a frenzy in DeFi governance tokens, with Compound’s COMP token kickstarting the phenomenon.

The process is relatively simple: DeFi users “farm” new governance tokens by staking various cryptocurrencies, such as Ether (ETH).

DeFi protocols that release their underlying governance tokens in a decentralized manner distribute them over time to users who stake.

Once users successfully farm the new tokens, they typically hold them until they can be sold at centralized exchanges but sometimes the token’s market cap is too small.

Top cryptocurrency exchanges have to consider various factors before listing tokens. Some of the criteria include liquidity, track record, and developer activity. For new governance tokens or DeFi-related cryptocurrencies, it is nearly impossible to meet those requirements.

Hence, Uniswap eventually evolved into the go-to platform to trade DeFi tokens and as the total value locked in DeFi surged it intensified the growth of Uniswap’s volume.

Is DEX volume a one-off or a trend?

Uniswap first surpassed Coinbase Pro in daily volume on Aug. 30. Since then, it has continuously remained competitive with the top U.S. exchange. In late August Uniswap creator Hayden Adams said:

“Wow, Uniswap 24hr trading volume is higher than Coinbase for the first time ever. Uniswap: $426M, Coinbase: $348M Hard to express with how crazy this is.”

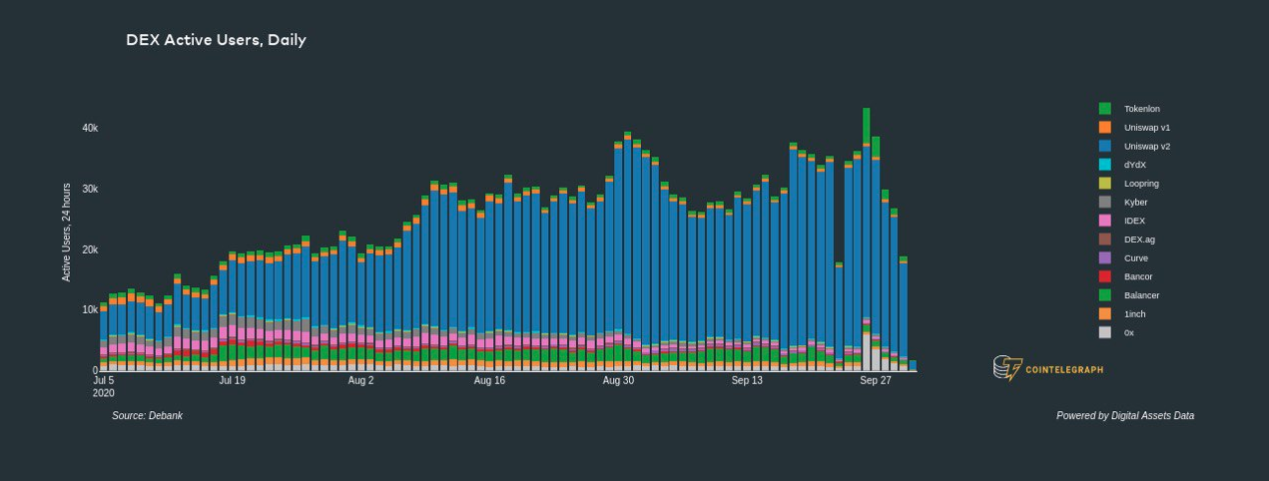

The consistently high volume from Uniswap occurred despite a considerable slowdown in yield farming and the governance token craze. This suggests that the uptrend of decentralized exchanges maintaining high volume is sustainable over the long term.

Decentralized exchange active users. Source: Digital Assets Data (Click image for larger view)

Decentralized exchange active users. Source: Digital Assets Data

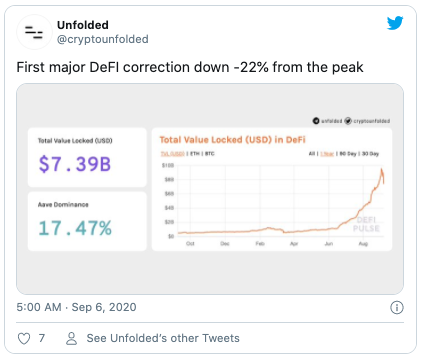

In the last few weeks the prices of DeFi tokens dropped and user activity in yield farming space declined but researchers at Dune Analytics are not interpreting this as a bearish signal. The researchers said:

“Despite yield farming craze calming down DEX volumes crushed old records in September: $24B traded, up 100% from August. While last few weeks were down from beginning of month, all weeks in Sept were well above peak week from August.”

Ethereum analysts, including Ethhub founder Anthony Sassano, said it also reflects the overwhelmingly positive sentiment investors have for Ethereum. Sassano said:

“They told you that decentralized exchanges on Ethereum were a fad – they were so incredibly wrong. DEXs did $23.5 billion worth of volume in September alone! Betting against Ethereum has and always always will be a bad move.”

Original article posted on the CoinTelegraph.com site, by Joseph Young.

Article re-posted on Markethive by Jeffrey Sloe